Working Capital to Keep Business Moving

Every business faces cash flow gaps. Slow paying customers, seasonal dips, unexpected opportunities. Working capital loans bridge those gaps so you can focus on growth, not survival.

What You Need to Qualify

$5,000+

Minimum Monthly Revenue

3+ months

Established Business History

How much funding do you need?

Drag the slider or type an amount

Applying is free and won't impact your credit score

Get Working Capital in Your Account Fast

Share your funding amount, timeline, and what you plan to use the capital for. Takes about 5 minutes.

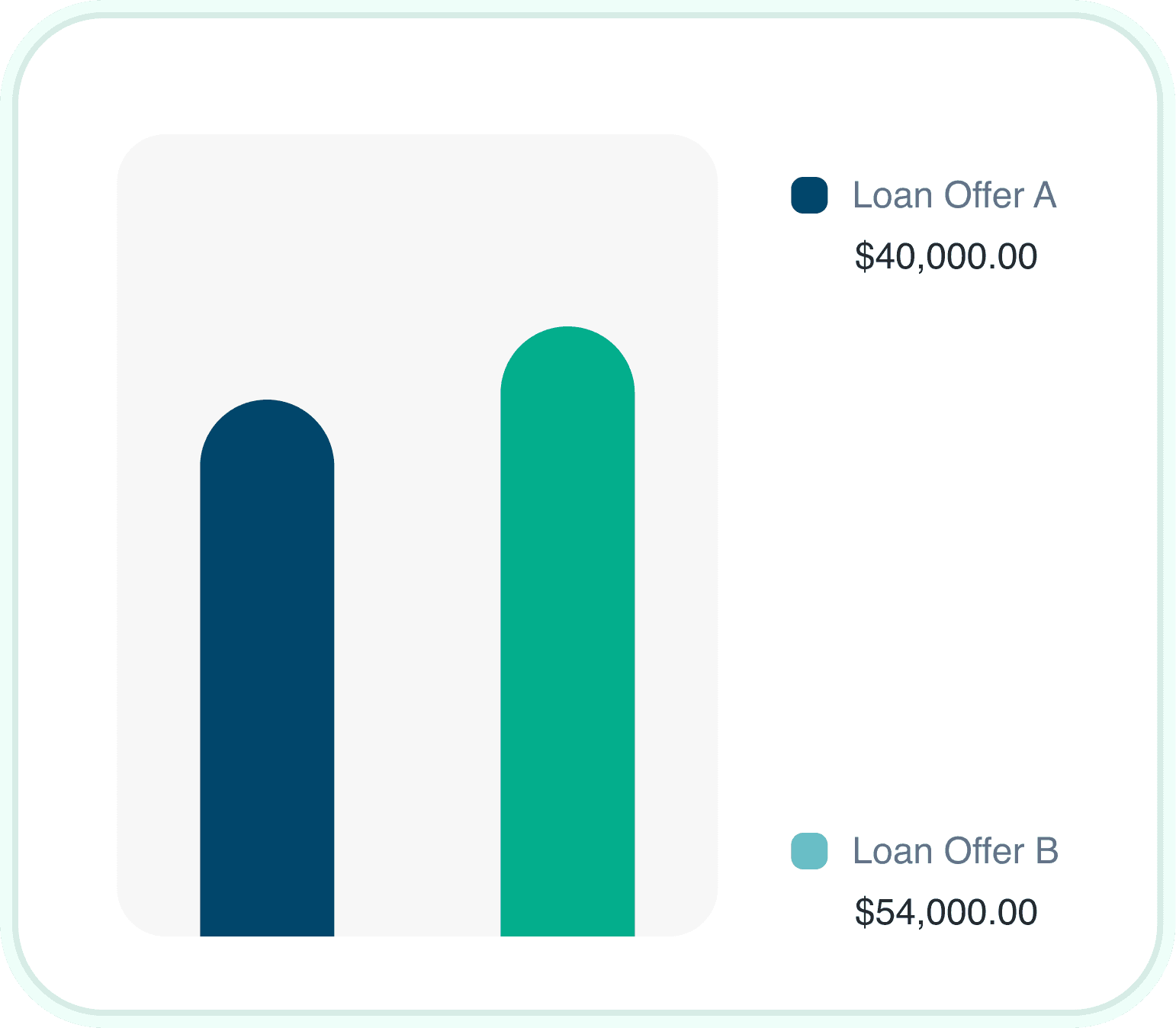

Receive multiple offers with different terms and rates. See exactly what each option costs before deciding.

Choose the funding option that fits your cash flow. Our team handles the paperwork efficiently.

Funds arrive in your business account, typically within 24 to 48 hours. Start deploying capital immediately.

What Makes Our Working Capital Different

Use Funds for Any Business Purpose

Payroll, inventory, marketing, equipment, rent, vendor payments, or opportunity investments. No restrictions on capital deployment.

Predictable Fixed Payments

Know exactly what you owe each week or month. Fixed payments make budgeting straightforward and eliminate surprise costs.

Speed When It Matters

Most applications receive a decision within hours, not weeks. When opportunity knocks or crisis hits, you need capital fast.

Minimal Documentation Required

Three months of bank statements and basic business info. No lengthy business plans or years of tax returns needed.

No Collateral for Most Loans

Unsecured working capital means you keep your assets unencumbered. Perfect for businesses without significant property.

Renew and Grow Over Time

Build a track record with us and qualify for larger amounts and better terms on future funding needs.

Understanding Working Capital Loans

Working capital loans provide the liquidity businesses need to operate day to day. Unlike term loans for major investments, these funds cover ongoing operational costs and short-term needs.

The best businesses plan for cash flow gaps before they happen. Seasonal slowdowns, large inventory purchases, delayed customer payments, or rapid growth all create legitimate capital needs. Working capital loans give you the financial flexibility to navigate these situations without disrupting operations or missing opportunities.

Working Capital Loan Details

Our working capital products are designed for speed and flexibility. Businesses use these funds to cover operating expenses, take advantage of growth opportunities, or smooth out cash flow fluctuations throughout the year.

Funds can be used for any legitimate business purpose. There are no restrictions on how you deploy your working capital.

Common Uses for Working Capital

Business owners use working capital loans to address a wide range of operational needs. Here are the most common applications.

Covering Payroll During Slow Periods

Keep your team paid during seasonal dips or when customer payments run behind. Retaining good employees is critical for business continuity.

Purchasing Inventory Ahead of Demand

Stock up before busy seasons or take advantage of bulk pricing from suppliers. Adequate inventory prevents lost sales.

Funding Marketing Campaigns

Invest in advertising, promotions, or market expansion when you see opportunity. Marketing often requires upfront spend before returns materialize.

Managing Vendor Payment Terms

Pay suppliers on time to maintain relationships and capture early payment discounts. Strong vendor relationships support long-term growth.

Covering Emergency Repairs

Equipment breakdowns and facility issues cannot wait. Working capital ensures you can address problems immediately.

Bridging Gaps in Receivables

When customers pay net 30, 60, or 90, your bills still come due. Working capital bridges the gap between invoicing and payment.

Credit Requirements for Working Capital

Working capital loans are available across a range of credit profiles. Your business performance often matters more than your personal credit score.

Good News

Business owners with credit scores from 500 to 800 successfully qualify for working capital every day. We have options for various credit situations.

Excellent Credit (700+)

Lowest rates, highest amounts, longest terms available

Fair Credit (500-699)

Competitive options based on business revenue and performance

Working Capital Financing Trends

82%

of small businesses experience cash flow issues at some point. Working capital provides the buffer to navigate these challenges.

(Source: QuickBooks State of Cash Flow Survey)

$250K

average working capital loan amount for small businesses. Most are used for inventory, payroll, and operational expenses.

(Source: Industry Analysis 2023)

6 months

most common term length for working capital loans. Short terms mean fast repayment and lower total cost of capital.

(Source: Lending Market Data)

Evaluating Working Capital Loans

Fast access to capital when you need it most

No restrictions on fund usage for business purposes

Fixed payment schedule simplifies cash flow planning

No collateral required for most loan amounts

Build business credit with consistent payments

Renew and scale funding as your business grows

Higher cost than long-term bank loans

Shorter repayment periods than traditional financing

Requires consistent revenue to qualify

May need personal guarantee depending on loan size

Compare Working Capital to Other Products

| Loan Type | Max Amount | Rates | Speed |

|---|---|---|---|

| Working Capital Loan | $25K to $5M | 1% to 4% monthly | 24 to 48 hours |

| Business Line of Credit | $25K to $5M | 1% to 3% monthly | 1 to 3 days |

| Merchant Cash Advance | $10K to $5M | Factor 1.1 to 1.5 | 1 to 2 days |

| Business Term Loan | $50K to $5M | 6% to 25% APR | 1 to 3 days |

| Revenue Based Financing | $10K to $5M | 1% to 6% monthly | 1 to 2 days |

| SBA Loan | $50K to $5M | Prime + 2.75% | 8 to 12 weeks |

Working Capital Qualification Requirements

500+

Credit Score

$15K+

Monthly Revenue

6+ months

Time in Business

Apply for Working Capital Today

The application takes minutes, and most business owners receive a funding decision the same day. No lengthy paperwork or waiting.

Get Started Now

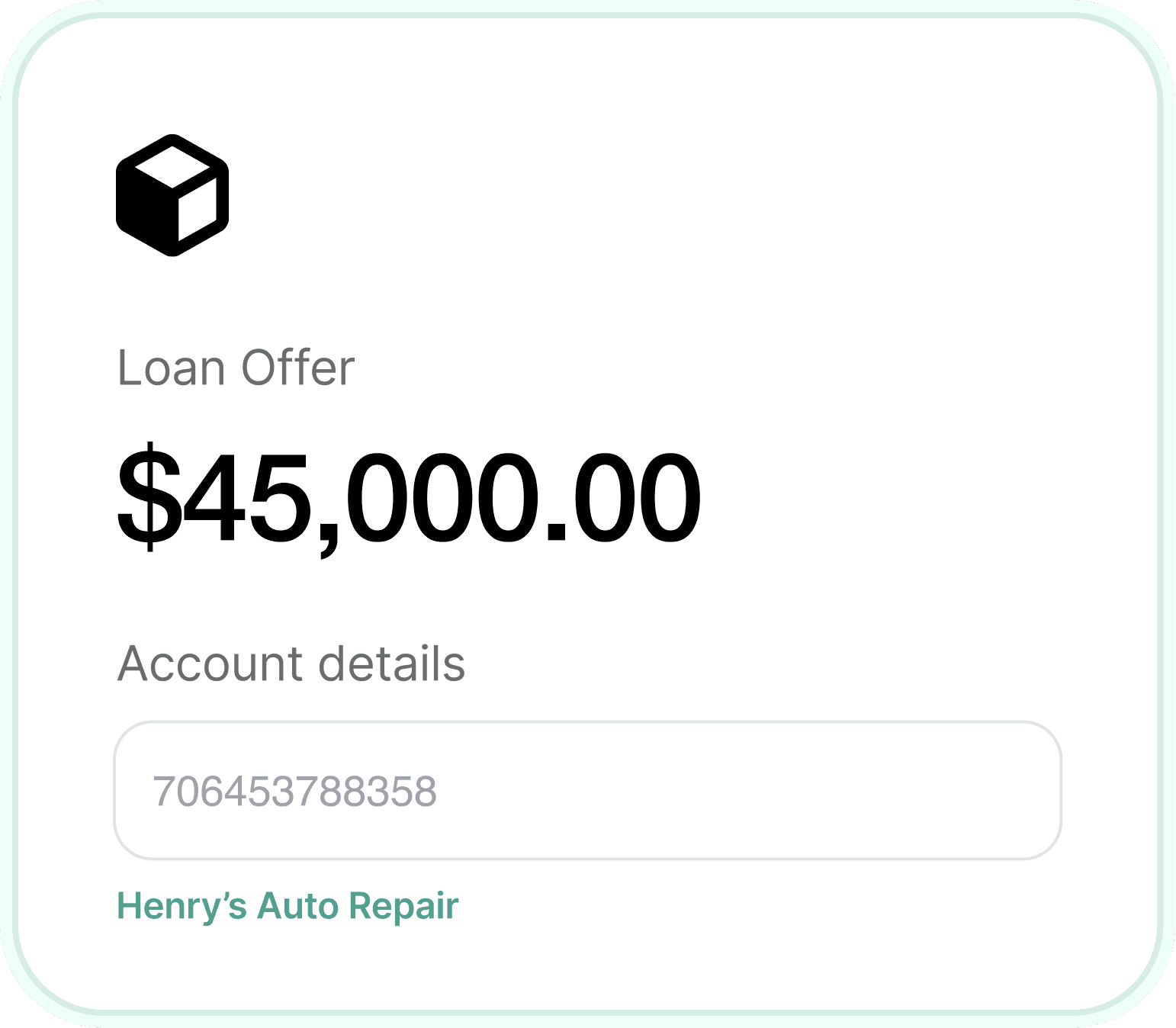

Provide basic information about your business, including revenue, industry, and funding needs. Takes approximately 5 minutes.

Upload your last 3 months of business bank statements. Additional documents may be requested for larger funding amounts.

Review funding offers, compare terms and costs, and choose the option that best fits your business needs and cash flow.

Alternative Funding Options

Depending on your situation, these products might also meet your business needs.

Working Capital by Industry

Specialized working capital programs with terms tailored to specific industry needs.

Working Capital Loan Questions

Working capital loans are designed for short-term operational needs and typically have terms of 3 to 18 months. Term loans are for larger investments with longer repayment periods of 2 to 5 years or more. Working capital is better suited for cash flow management and immediate expenses.

Yes, working capital loans have no restrictions on business use. Payroll, inventory, marketing, rent, equipment repairs, vendor payments, and any other legitimate business expense can be covered with these funds.

Most working capital loans fund within 24 to 48 hours after approval. Some same-day funding options are available depending on when your application is submitted and approved.

Most working capital loans are unsecured, meaning no collateral is required. For larger amounts or certain credit profiles, lenders may request a UCC filing or personal guarantee, but physical assets are rarely needed.

Working capital loans are available for credit scores starting at 500. Higher scores typically qualify for better rates and terms, but strong business revenue can offset credit challenges.

Most working capital loans feature fixed daily or weekly payments debited directly from your business bank account. This structure provides predictable budgeting and fast repayment.

Many lenders offer early payoff options with reduced fees. Check with your funding advisor about prepayment terms for your specific offer.

Working capital amounts typically range from $25,000 to $5,000,000 based on your monthly revenue, time in business, and overall business health. Most businesses qualify for 10% to 20% of their annual revenue.

Some lenders report payment history to business credit bureaus. Consistent on-time payments can help build your business credit profile and improve future financing options.

Basic requirements include 3 months of business bank statements, a valid ID, and proof of business ownership. Larger loan amounts may require additional documentation like tax returns or financial statements.

Get Working Capital Today

Apply in minutes and receive funding decisions fast. Our team is ready to help you find the right working capital solution.

How much funding do you need?

Drag the slider or type an amount

Applying is free and won't impact your credit score