Funding That Powers Your Fitness Business Growth

The fitness industry demands constant investment—fresh equipment, facility updates, and competitive programming. We provide capital solutions that understand the membership-based revenue model and help gyms and studios compete.

What You Need to Qualify

$5,000+

Minimum Monthly Revenue

3+ months

Established Business History

How much funding do you need?

Drag the slider or type an amount

Applying is free and won't impact your credit score

From Application to Funding Without Missing a Workout

Share your gym type, membership numbers, monthly revenue, and what you need funding for. We understand fitness business models.

We assess your business with knowledge of recurring revenue, member retention, and the economics of fitness facilities.

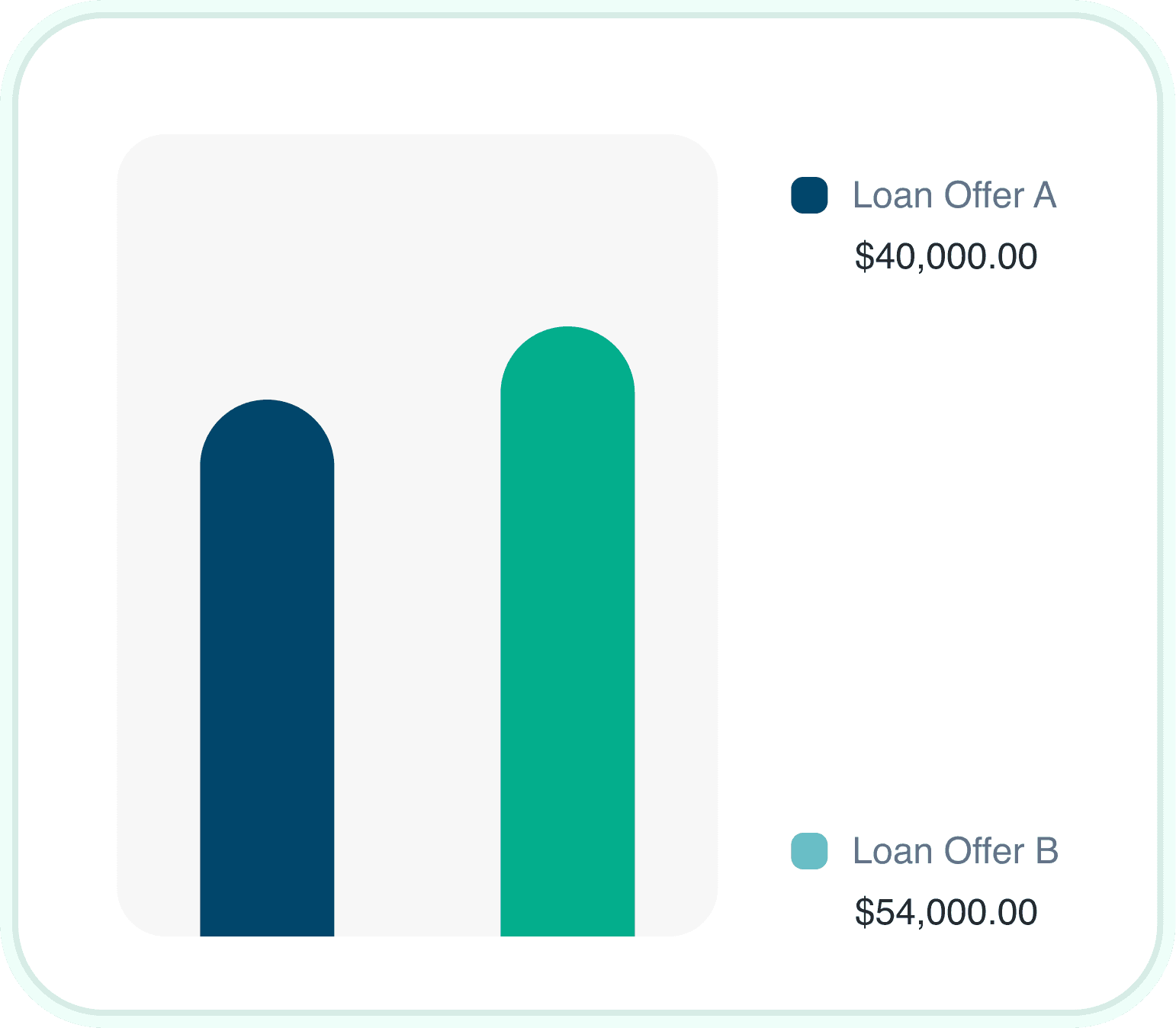

Review multiple funding offers with different structures. Pick what works for your cash flow and growth plans.

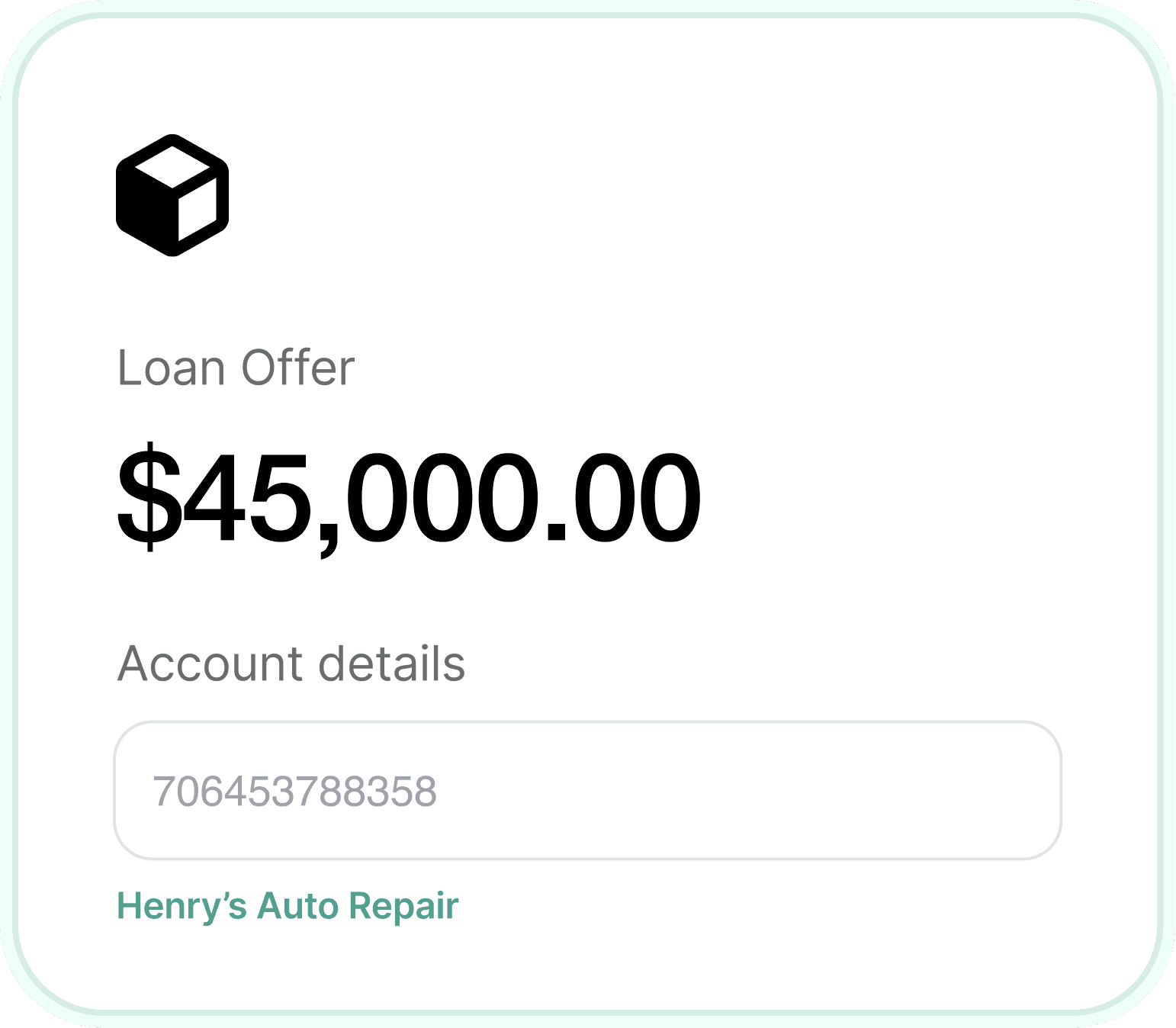

Funds arrive quickly—often within 24-48 hours. Order equipment, sign that lease expansion, or launch your marketing campaign.

Why Fitness Business Owners Choose Us for Funding

We Understand Membership Revenue

Recurring monthly fees, annual contracts, and seasonal signup patterns create unique cash flow dynamics. We evaluate your business appropriately.

Equipment That Keeps Members Engaged

Outdated cardio machines and worn weight equipment drive members away. Our equipment financing keeps your facility competitive.

Seasonal Cash Flow Support

January rushes and summer slowdowns create uneven revenue. Our working capital solutions help smooth out these natural fluctuations.

All Fitness Concepts Welcome

Traditional gyms, CrossFit boxes, yoga studios, Pilates, martial arts, boutique fitness—we fund the full spectrum of fitness businesses.

Expansion and Buildout Funding

Opening a second location or expanding your current space requires significant capital. We help make growth happen.

Marketing Investment Support

Member acquisition campaigns drive growth. We provide capital for marketing initiatives, especially during key signup seasons.

Capital Built for the Fitness Industry

Whether you need to refresh your equipment floor, expand your studio, or bridge cash flow during slow months, we have funding solutions designed for fitness businesses.

Fitness businesses face unique financial pressures. Equipment needs constant updating. Lease costs keep rising. Competition from boutique concepts never stops. We have spent years learning the fitness industry so we can provide capital that makes sense for membership-based businesses with seasonal revenue patterns.

Fitness Business Funding Overview

We offer multiple products to address different gym and studio needs. Some owners need equipment financing for major refreshes. Others need working capital for marketing or slow-season support. Many use a combination.

Most fitness businesses qualify for multiple products. Your funding advisor will help compare options and recommend the best approach.

Financing Options for Gyms and Fitness Studios

Different business needs call for different solutions. Here are the products fitness owners use most frequently.

How Credit Affects Fitness Business Financing

Your personal credit score is one factor, but not everything. We evaluate the complete picture: membership count, recurring revenue, member retention, and overall business performance.

Good News

Fitness business owners with credit scores in the 500s regularly qualify for funding when they demonstrate solid membership numbers and healthy recurring revenue. Your business performance tells the story.

Strong Credit Profile

Access to lowest rates, longest terms, highest amounts

Challenged Credit

Multiple options available based on business performance

Fitness Industry Funding Insights

$35B+

US fitness industry annual revenue. Growing demand for health and wellness creates ongoing opportunities for well-capitalized facilities.

(Source: IBIS World)

60%

of gym members join in January but many cancel by March. Strategic capital helps you retain members year-round.

(Source: IHRSA)

$10K-$50K

typical annual equipment refresh budget for successful gyms. Our financing helps spread these costs over time.

(Source: Club Industry Report)

Evaluating Fitness Business Financing

Keep equipment fresh and members engaged

Expand to additional locations

Fund marketing during key signup seasons

Bridge cash flow during seasonal slowdowns

Renovate facilities to compete with new concepts

Build credit history for better future terms

Financing costs reduce overall margin

Some products require frequent payments

Personal guarantees may be required

Fast funding options typically cost more than SBA loans

Compare Fitness Business Funding Options

| Loan Type | Max Amount | Rates | Speed |

|---|---|---|---|

| Equipment Financing | $15K to $300K | 6% to 18% APR | 3 to 7 days |

| Merchant Cash Advance | $15K to $250K | Factor 1.1 to 1.5 | 24 to 48 hours |

| Working Capital Loan | $15K to $200K | 1% to 3% monthly | 24 to 48 hours |

| Business Line of Credit | $15K to $150K | 1% to 3% monthly | 1 to 3 days |

| Revenue-Based Financing | $15K to $500K | 1% to 5% monthly | 1 to 3 days |

Fitness Business Qualification Requirements

$10K+

Monthly Revenue

500+

Credit Score

6+ months

Time in Business

Get Funding for Your Fitness Business

Apply today and receive funding decisions quickly. Our team understands fitness business financing and membership-based revenue models.

Start Your Application

Complete a short application about your gym or studio, including your concept, membership count, and funding needs.

Upload recent bank statements and basic business information. We review them with an understanding of fitness revenue patterns.

Review your offers, choose the best fit, and receive funds. Most fitness businesses get funded within 24 to 48 hours.

Fitness Business Funding Products

Explore specific financing options available for your gym or studio.

Related Industries We Fund

We also specialize in financing for these related industries.

Fitness Business Financing Questions

We fund traditional gyms, CrossFit boxes, yoga studios, Pilates studios, martial arts schools, spin studios, personal training studios, wellness centers, and boutique fitness concepts.

Yes, we can finance treadmills, ellipticals, weight machines, free weights, functional training equipment, studio-specific gear, and all other fitness equipment.

We work with both independent gyms and franchise locations. Franchise owners may need franchisor approval for certain funding uses.

Yes, though requirements vary. Newer facilities typically need at least 6 months of operation and demonstrated membership growth.

We understand January rushes and summer slowdowns. Some of our products have payments that adjust with revenue, and we can structure terms to account for seasonality.

It matters, but business performance often outweighs credit challenges. We have funded many gym owners with credit scores below 600 who show solid membership numbers.

Many gyms receive decisions within 24 hours and funding within 24-48 hours. Equipment financing takes slightly longer, typically 3-7 days.

Basic requirements include 3-6 months of bank statements, a valid ID, and proof of business ownership. Larger amounts require additional documentation.

Ready to Grow Your Fitness Business?

Whether you need equipment, expansion capital, or working capital, our team specializes in fitness business financing and understands your unique challenges.

How much funding do you need?

Drag the slider or type an amount

Applying is free and won't impact your credit score