Capital That Helps Your Business Shine

Cleaning businesses grow by landing bigger contracts, expanding service areas, and investing in professional equipment. We provide funding that helps you scale your operation and serve more clients.

What You Need to Qualify

$5,000+

Minimum Monthly Revenue

3+ months

Established Business History

How much funding do you need?

Drag the slider or type an amount

Applying is free and won't impact your credit score

From Application to Funding in Record Time

Share your cleaning specialty, client base, and what you need funding for. We understand janitorial and cleaning service operations.

We assess your business with knowledge of recurring contracts, service revenue patterns, and the economics of cleaning operations.

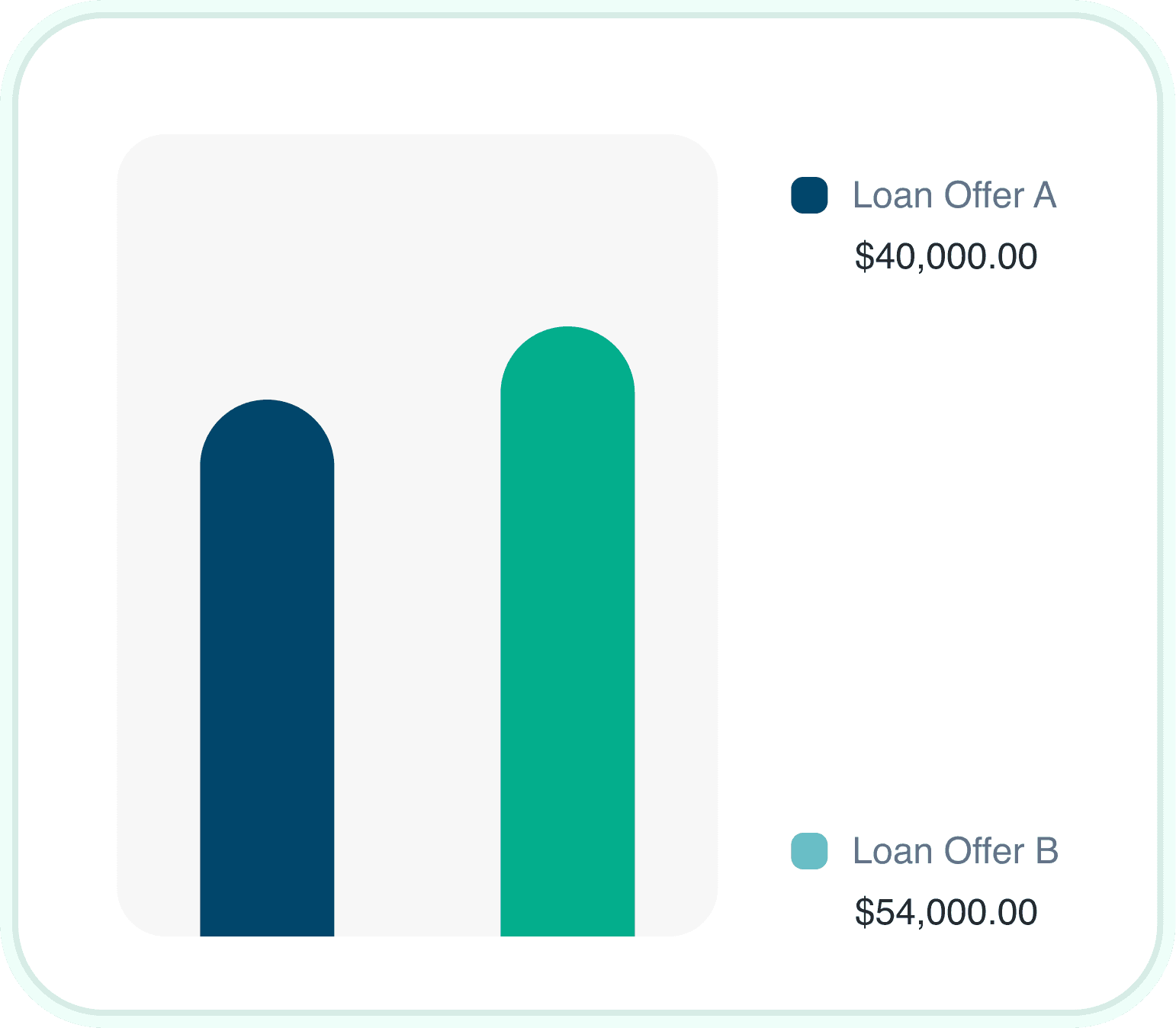

Review multiple funding offers with different structures. Pick what aligns with your contract revenue and growth plans.

Funds arrive quickly—often within 24-48 hours. Buy equipment, add vehicles, or scale up for that big contract.

Why Cleaning Business Owners Choose Us

We Understand Service Contract Economics

You pay workers weekly, but commercial clients pay 30-60 days after service. We structure funding that bridges this gap.

Equipment That Wins Bigger Contracts

Commercial-grade equipment and vehicles help you compete for larger accounts. Our financing supports your professional image.

Contract Ramp-Up Support

Landing a big commercial contract requires capacity before revenue starts. Our working capital helps you scale up confidently.

All Cleaning Services Welcome

Commercial janitorial, residential cleaning, carpet cleaning, pressure washing, window cleaning, specialty services—we fund it all.

Fleet and Vehicle Funding

Adding vans and vehicles expands your service area. Our financing helps you build the fleet your growing business needs.

Fast Decisions for Fast Growth

When big contracts land, you cannot wait weeks for approval. Our speed helps you say yes to opportunities.

Funding Built for Cleaning Business Growth

Whether you need commercial equipment, service vehicles, or working capital to scale for new contracts, we have funding solutions designed for cleaning businesses.

Cleaning businesses face unique scaling challenges. You need to pay workers before clients pay you. Equipment upgrades require upfront investment. Landing commercial contracts requires capacity you may not have yet. We have spent years learning the cleaning industry so we can provide capital that helps you grow from residential to commercial, from local to regional.

Cleaning Business Funding Overview

We offer multiple products to address different cleaning business needs. Some owners need equipment financing for commercial upgrades. Others need working capital for payroll and growth. Many use a combination.

Most cleaning businesses qualify for multiple products. Your funding advisor will help compare options and recommend the best approach.

Financing Options for Cleaning Businesses

Different business needs call for different solutions. Here are the products cleaning companies use most frequently.

How Credit Affects Cleaning Business Financing

Your personal credit score is one factor, but not everything. We evaluate the complete picture: contract revenue, client roster, service history, and overall business performance.

Good News

Cleaning business owners with credit scores in the 500s regularly qualify for funding when they demonstrate solid contract revenue and reliable service. Your business performance tells the story.

Strong Credit Profile

Access to lowest rates, longest terms, highest amounts

Challenged Credit

Multiple options available based on business performance

Cleaning Industry Funding Insights

$90B+

annual US cleaning services industry revenue. Growing demand for professional cleaning creates opportunities for well-capitalized businesses.

(Source: IBIS World)

30-60

average days for commercial clients to pay invoices. Our funding bridges this gap so you can pay workers on time.

(Source: Cleaning Industry Survey)

65%

of cleaning businesses use external financing for equipment or growth. Capital is a normal part of service business expansion.

(Source: Service Industry Report)

Evaluating Cleaning Business Financing

Invest in commercial-grade equipment

Add vehicles to expand service area

Bridge payroll gaps from contract timing

Scale up capacity for larger contracts

Fund marketing for new clients

Build credit history for better future terms

Financing costs reduce overall margin

Some products require frequent payments

Personal guarantees may be required

Fast funding options typically cost more

Compare Cleaning Business Funding Options

| Loan Type | Max Amount | Rates | Speed |

|---|---|---|---|

| Equipment Financing | $10K to $150K | 6% to 18% APR | 3 to 5 days |

| Invoice Factoring | $10K to $150K | 1% to 4% per invoice | 24 to 48 hours |

| Working Capital Loan | $10K to $150K | 1% to 3% monthly | 24 to 48 hours |

| Business Line of Credit | $10K to $100K | 1% to 3% monthly | 1 to 3 days |

| Revenue-Based Financing | $10K to $250K | 1% to 5% monthly | 1 to 3 days |

Cleaning Business Qualification Requirements

$8K+

Monthly Revenue

500+

Credit Score

6+ months

Time in Business

Get Funding for Your Cleaning Business

Apply today and receive funding decisions quickly. Our team understands cleaning service financing and contract-based revenue.

Start Your Application

Complete a short application about your business, including your cleaning specialty, contract base, and funding needs.

Upload recent bank statements and basic business information. We review them with an understanding of service business patterns.

Review your offers, choose the best fit, and receive funds. Many cleaning businesses get funded the same day.

Cleaning Business Funding Products

Explore specific financing options available for your cleaning company.

Related Industries We Fund

We also specialize in financing for these related industries.

Cleaning Business Financing Questions

We fund commercial janitorial, residential cleaning, carpet cleaning, pressure washing, window cleaning, specialty cleaning, and restoration services of all sizes.

Yes, you can finance vans, trucks, trailers, and vehicles to expand your service capabilities and reach.

We work with both independent cleaning companies and franchise operations. Franchise owners may need franchisor approval for certain uses.

We understand that commercial contracts create predictable but delayed revenue. Our products are structured for this reality.

Yes, working capital can help you scale up staff and supplies when you land new commercial accounts.

It matters, but business performance often outweighs credit challenges. Strong contract revenue and service history matter significantly.

Many cleaning business owners receive funding the same day they apply. Equipment financing takes slightly longer.

Basic requirements include 3-6 months of bank statements, a valid ID, and proof of business ownership.

Ready to Grow Your Cleaning Business?

Whether you need equipment, vehicles, or working capital, our team specializes in cleaning service financing and understands your business needs.

How much funding do you need?

Drag the slider or type an amount

Applying is free and won't impact your credit score