Capital That Elevates Your Guest Experience

Hospitality and service businesses thrive on creating memorable experiences. We provide funding that helps you renovate facilities, upgrade equipment, and invest in the details that keep guests coming back.

What You Need to Qualify

$5,000+

Minimum Monthly Revenue

3+ months

Established Business History

How much funding do you need?

Drag the slider or type an amount

Applying is free and won't impact your credit score

From Application to Funding Without the Wait

Share your business type, monthly revenue, and what you need funding for. We understand hotels, salons, spas, and service businesses.

We assess your business with knowledge of seasonal patterns, recurring customers, and the economics of service-based operations.

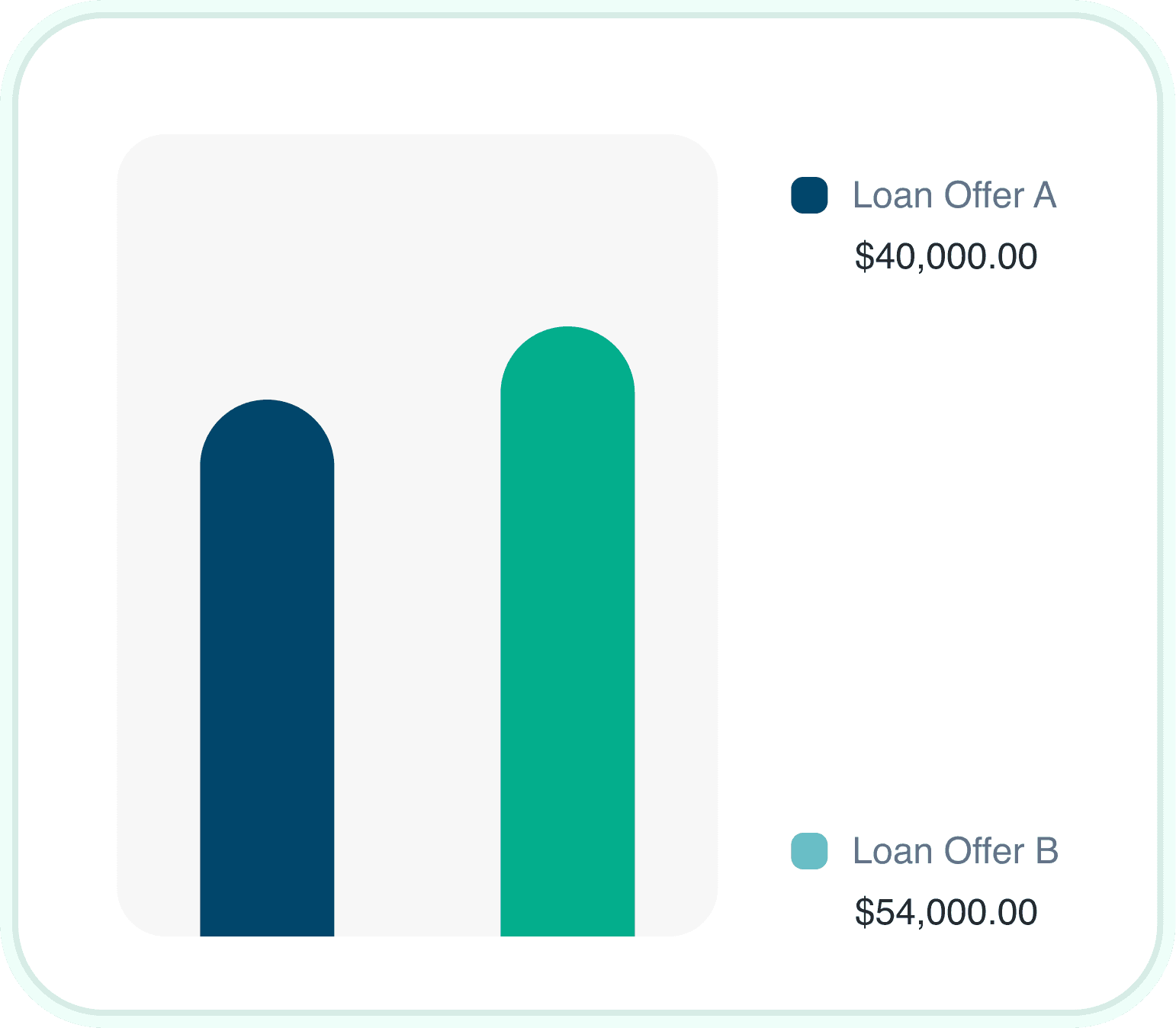

Review multiple funding offers with different structures. Pick what aligns with your cash flow and busy seasons.

Funds arrive quickly—often within 24-48 hours. Start that renovation, order equipment, or prepare for your busy season.

Why Hospitality and Service Businesses Choose Us

We Understand Seasonal Revenue

Tourism peaks, holiday seasons, and local events create revenue fluctuations. We evaluate your business with this reality in mind.

Renovation and Refresh Support

Staying competitive requires regular updates to facilities. Our financing helps you modernize without depleting cash reserves.

Equipment That Enables Great Service

Salon chairs, spa equipment, hotel amenities, laundry systems—we finance the tools that make exceptional service possible.

All Service Types Welcome

Hotels, motels, B&Bs, salons, spas, barber shops, cleaning services, event venues—we fund the full hospitality spectrum.

Seasonal Payment Flexibility

Some of our products can be structured to align payments with your busy seasons, reducing strain during slower periods.

Fast Turnaround for Opportunities

Property opportunities and renovation windows do not wait. Our speed helps you act when timing matters.

Funding Built for the Service Industry

Whether you need to renovate hotel rooms, upgrade salon stations, or prepare for your busy season, we have funding solutions designed for hospitality and service businesses.

Hospitality businesses face unique financial pressures. Facilities need constant updating. Seasonal demand creates revenue swings. Competition for guests and customers never stops. We have spent years learning the service industry so we can provide capital that makes sense for businesses focused on exceptional guest experiences.

Hospitality Business Funding Overview

We offer multiple products to address different hospitality needs. Some businesses need renovation financing for major projects. Others need working capital for seasonal preparation. Many use a combination.

Most hospitality businesses qualify for multiple products. Your funding advisor will help compare options and recommend the best approach.

Financing Options for Hospitality Businesses

Different business needs call for different solutions. Here are the products hospitality and service businesses use most frequently.

How Credit Affects Hospitality Business Financing

Your personal credit score is one factor, but not everything. We evaluate the complete picture: revenue history, seasonal patterns, customer base, and overall business performance.

Good News

Hospitality business owners with credit scores in the 500s regularly qualify for funding when they demonstrate solid revenue and healthy customer flow. Your business performance tells the story.

Strong Credit Profile

Access to lowest rates, longest terms, highest amounts

Challenged Credit

Multiple options available based on business performance

Hospitality Industry Funding Insights

$1.1T

US hospitality industry annual revenue. Growing travel and service demand creates opportunities for well-capitalized businesses.

(Source: American Hotel & Lodging Association)

65%

of hospitality businesses invest in renovations every 3-5 years. Regular updates keep guests satisfied and competitive positioning strong.

(Source: Hospitality Industry Report)

40%

revenue variance between peak and off-peak seasons for many hospitality businesses. Strategic capital helps smooth these fluctuations.

(Source: Service Industry Data)

Evaluating Hospitality Business Financing

Renovate facilities to stay competitive

Upgrade equipment that enables great service

Bridge cash flow during seasonal slowdowns

Expand to additional locations or services

Prepare for busy seasons with inventory

Build credit history for better future terms

Financing costs reduce overall margin

Some products require frequent payments

Personal guarantees may be required

Fast funding options typically cost more

Compare Hospitality Funding Options

| Loan Type | Max Amount | Rates | Speed |

|---|---|---|---|

| Merchant Cash Advance | $25K to $300K | Factor 1.1 to 1.5 | 24 to 48 hours |

| Equipment Financing | $15K to $250K | 6% to 18% APR | 3 to 7 days |

| Working Capital Loan | $25K to $5M | 1% to 3% monthly | 24 to 48 hours |

| Business Term Loan | $50K to $500K | 8% to 20% APR | 3 to 7 days |

| SBA Loan | $50K to $500K | Prime + 2.75% | 8 to 12 weeks |

Hospitality Business Qualification Requirements

$10K+

Monthly Revenue

500+

Credit Score

6+ months

Time in Business

Get Funding for Your Hospitality Business

Apply today and receive funding decisions quickly. Our team understands hospitality financing and seasonal service industry needs.

Start Your Application

Complete a short application about your business, including your type, monthly revenue, and funding needs.

Upload recent bank statements and basic business information. We review them with an understanding of hospitality revenue patterns.

Review your offers, choose the best fit, and receive funds. Most hospitality businesses get funded within 24 to 48 hours.

Hospitality Funding Products

Explore specific financing options available for your hospitality or service business.

Related Industries We Fund

We also specialize in financing for these related industries.

Hospitality Business Financing Questions

We fund hotels, motels, bed and breakfasts, salons, spas, barber shops, nail salons, cleaning services, event venues, and other service-based businesses.

Yes, renovation financing is one of our key products for hospitality businesses looking to upgrade their facilities and guest experience.

We offer flexible payment options that can be structured around your busy and slow seasons, reducing financial strain during off-peak periods.

Yes, we work with both independent operators and franchisees across the hospitality and service industries.

Absolutely. We finance salon chairs, spa tables, beauty equipment, and all service industry equipment.

It matters, but business performance often outweighs credit challenges. We have funded many hospitality owners with credit scores below 600 who show solid revenue.

Many businesses receive decisions within 24 hours and funding within 24-48 hours. This speed helps you prepare for busy seasons or act on opportunities.

Basic requirements include 3-6 months of bank statements, a valid ID, and proof of business ownership. Larger amounts require additional documentation.

Ready to Elevate Your Guest Experience?

Whether you need renovation capital, equipment financing, or working capital, our team specializes in hospitality business financing and understands your seasonal needs.

How much funding do you need?

Drag the slider or type an amount

Applying is free and won't impact your credit score