Capital That Moves as Fast as Your Sales

Retail and e-commerce success depends on having the right inventory at the right time. We provide funding solutions that help you stock up for peak seasons, invest in marketing, and grow your sales channels.

What You Need to Qualify

$5,000+

Minimum Monthly Revenue

3+ months

Established Business History

How much funding do you need?

Drag the slider or type an amount

Applying is free and won't impact your credit score

From Application to Funding in Time for Your Next Order

Share your sales channels, monthly revenue, and what you need funding for. We understand both brick-and-mortar and e-commerce models.

We assess your business with knowledge of inventory cycles, seasonal patterns, and the economics of retail operations.

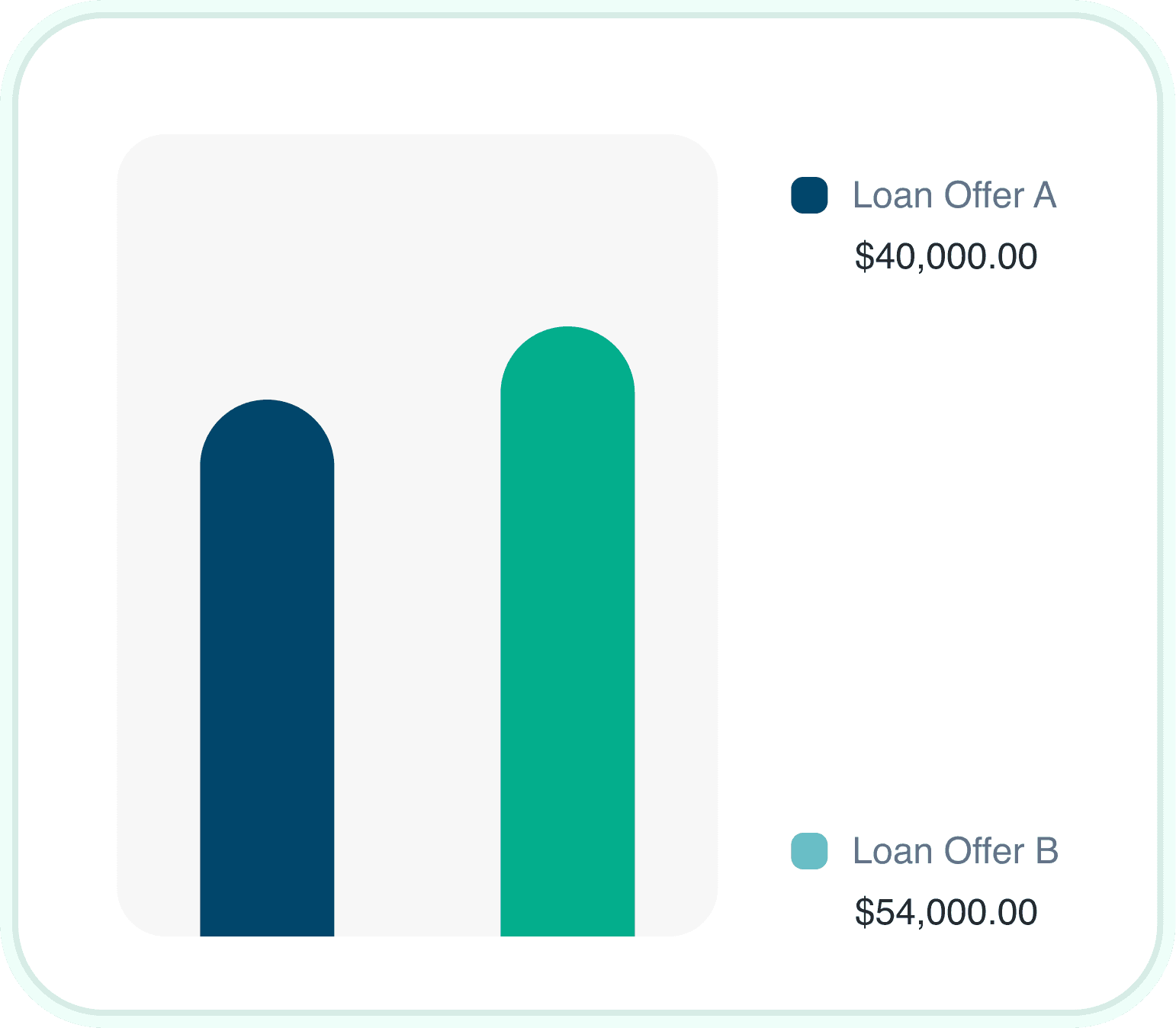

Review multiple funding offers with different structures. Pick what aligns with your sales cycle and inventory needs.

Funds arrive quickly—often within 24-48 hours. Place that bulk order, stock up for the season, or launch your marketing campaign.

Why Retail and E-commerce Businesses Choose Us

We Understand Inventory Economics

You buy inventory months before you sell it, creating cash flow gaps. We evaluate your business with this reality in mind.

Seasonal Funding Support

Peak seasons require significant upfront investment. Our funding helps you stock up for holidays, back-to-school, or your industry's busy periods.

E-commerce Expertise

Amazon, Shopify, eBay, Walmart—we work with sellers across all platforms and understand marketplace economics and payout timing.

Multi-Channel Support

Whether you sell online, in stores, or both, we can structure funding that works for your entire operation.

Marketing Investment

Customer acquisition drives growth. We provide capital for advertising, promotions, and marketing campaigns.

Fast Turnaround

Buying opportunities and inventory deals do not wait. Our speed helps you capitalize on time-sensitive opportunities.

Funding Built for the Pace of Retail

Whether you need to stock up for a major season, invest in marketing, or expand to new channels, we have funding solutions designed for retail and e-commerce businesses.

Retail businesses face unique financial pressures. You need inventory before you can sell it. Seasonal demand creates massive swings. Competition from larger players never stops. We have spent years learning retail economics so we can provide capital that makes sense for businesses with inventory and seasonal cash flow patterns.

Retail and E-commerce Funding Overview

We offer multiple products to address different retail needs. Some businesses need inventory financing for bulk purchases. Others need working capital for marketing or seasonal support. Many use a combination.

Most retail businesses qualify for multiple products. Your funding advisor will help compare options and recommend the best approach.

Financing Options for Retail and E-commerce

Different business needs call for different solutions. Here are the products retail businesses use most frequently.

How Credit Affects Retail Business Financing

Your personal credit score is one factor, but not everything. We evaluate the complete picture: sales history, revenue trends, inventory turnover, and overall business performance.

Good News

Retail business owners with credit scores in the 500s regularly qualify for funding when they demonstrate strong sales and healthy revenue trends. Your business performance often tells the real story.

Strong Credit Profile

Access to lowest rates, longest terms, highest amounts

Challenged Credit

Multiple options available based on sales performance

Retail Industry Funding Insights

30-40%

of annual retail sales occur during the holiday season. Strategic inventory funding helps you capture your share of this demand.

(Source: National Retail Federation)

$1T+

annual US e-commerce sales. Online selling continues to grow, creating opportunities for well-capitalized merchants.

(Source: US Census Bureau)

60%

of small retailers use external financing for inventory or growth. Capital is a normal part of retail operations.

(Source: Retail Industry Survey)

Evaluating Retail Business Financing

Stock up for peak seasons at bulk prices

Fund marketing and customer acquisition

Expand to new sales channels or locations

Take advantage of supplier discounts

Bridge cash flow during seasonal gaps

Build credit history for better future terms

Financing costs reduce overall margin

Some products require frequent payments

Personal guarantees may be required

Fast funding options typically cost more

Compare Retail Funding Options

| Loan Type | Max Amount | Rates | Speed |

|---|---|---|---|

| Merchant Cash Advance | $25K to $500K | Factor 1.1 to 1.5 | 24 to 48 hours |

| Working Capital Loan | $25K to $500K | 1% to 3% monthly | 24 to 48 hours |

| Business Line of Credit | $25K to $5M | 1% to 3% monthly | 1 to 3 days |

| Revenue-Based Financing | $25K to $5M | 1% to 5% monthly | 1 to 3 days |

| Equipment Financing | $10K to $250K | 6% to 18% APR | 3 to 7 days |

Retail Business Qualification Requirements

$15K+

Monthly Sales

500+

Credit Score

6+ months

Time in Business

Get Funding for Your Retail Business

Apply today and receive funding decisions quickly. Our team understands retail and e-commerce financing and seasonal inventory needs.

Start Your Application

Complete a short application about your business, including your sales channels, monthly revenue, and funding needs.

Upload recent bank statements and sales reports. We review them with an understanding of retail revenue patterns.

Review your offers, choose the best fit, and receive funds. Most retail businesses get funded within 24 to 48 hours.

Retail Business Funding Products

Explore specific financing options available for your retail or e-commerce business.

Related Industries We Fund

We also specialize in financing for these related industries.

Retail and E-commerce Financing Questions

Yes, inventory financing is one of our most popular products for retail businesses. Stock up before peak seasons or take advantage of bulk discounts.

Absolutely. We work with e-commerce businesses across all platforms—Amazon, Shopify, eBay, Walmart, Etsy, and more—and understand marketplace economics.

We offer flexible payment structures that can align with your peak selling seasons, reducing strain during slower periods.

Yes, many retail businesses use funding for advertising, promotions, and customer acquisition campaigns, especially before key seasons.

We fund physical retail stores, online-only businesses, and omnichannel operations that sell through multiple channels.

It matters, but sales performance often outweighs credit challenges. We have funded many retailers with credit scores below 600 who demonstrate strong revenue.

Many retail businesses receive decisions within 24 hours and funding within 24-48 hours. This speed helps you act on inventory opportunities.

Basic requirements include 3-6 months of bank statements, marketplace sales reports if applicable, and proof of business ownership.

Ready to Grow Your Retail Business?

Whether you need inventory, marketing capital, or growth funding, our team specializes in retail and e-commerce financing and understands your seasonal needs.

How much funding do you need?

Drag the slider or type an amount

Applying is free and won't impact your credit score