Capital That Powers Your Property Investments

Real estate professionals need capital to move quickly on deals, fund renovations, bridge transactions, and scale their portfolio. We provide funding designed for the speed and flexibility real estate demands.

What You Need to Qualify

$5,000+

Minimum Monthly Revenue

3+ months

Established Business History

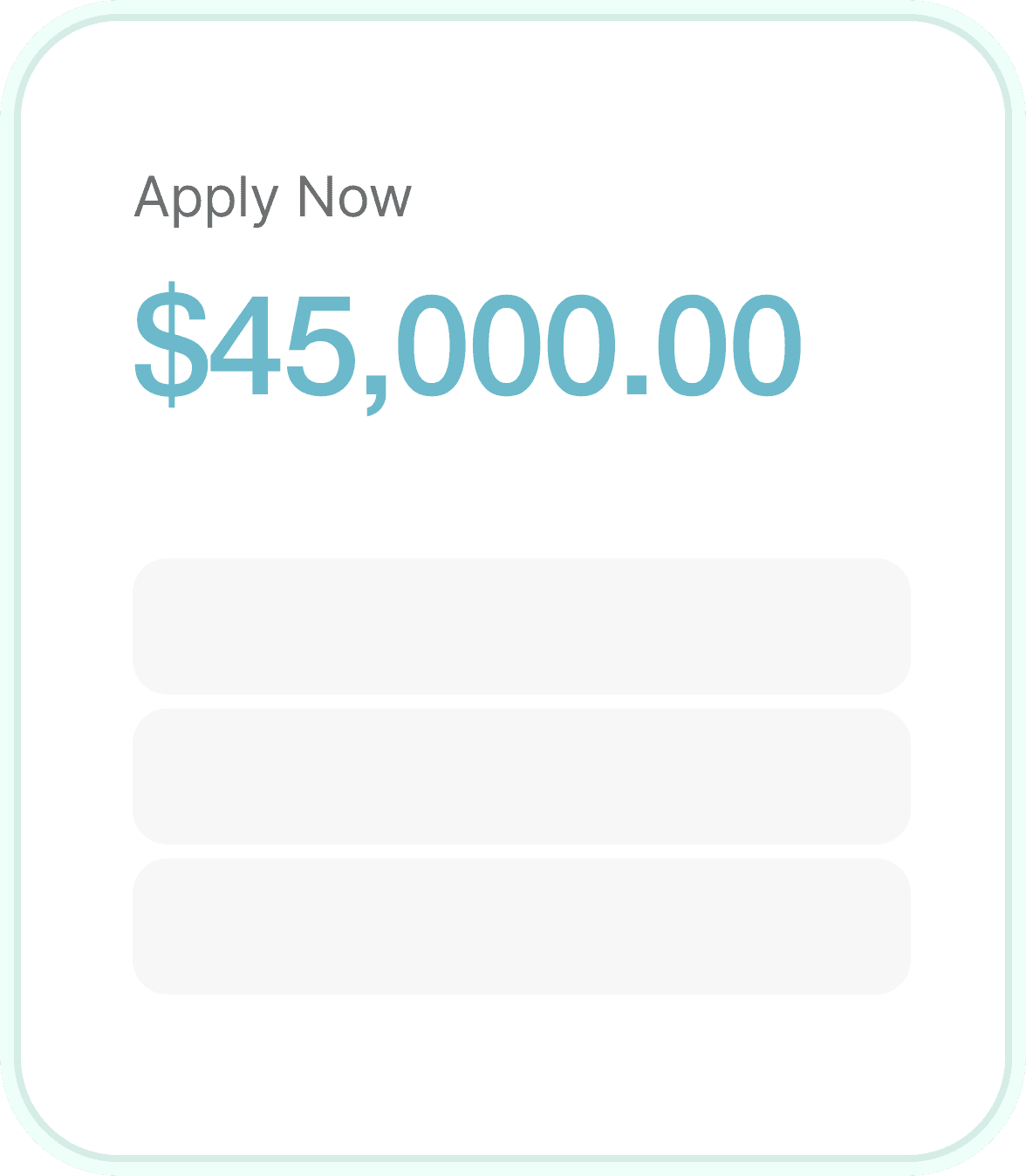

How much funding do you need?

Drag the slider or type an amount

Applying is free and won't impact your credit score

From Application to Funding at Deal Speed

Share your real estate focus, current portfolio, and what you need funding for. We understand investors, agents, and property managers.

We assess your business with knowledge of deal timelines, property economics, and the unique cash flow patterns of real estate.

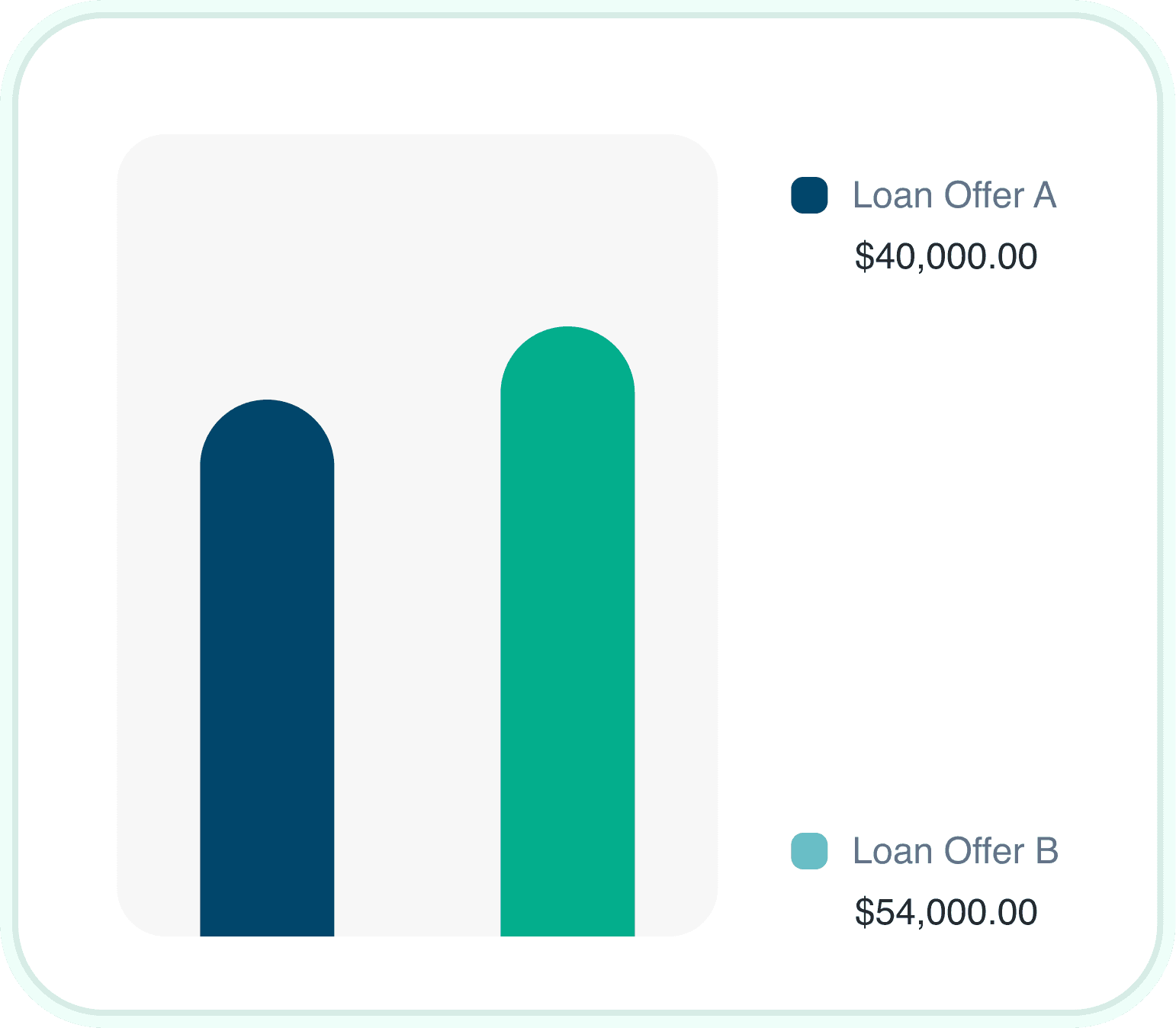

Review funding offers with structures that match your deal timeline. Choose what aligns with your property strategy.

Funds arrive quickly—often within 24-48 hours. Move fast on opportunities, fund renovations, or bridge to permanent financing.

Why Real Estate Professionals Choose Us

Speed That Matches Deal Flow

Good real estate deals go fast. Bank timelines do not work. We provide capital on real estate timelines—days, not weeks.

Investment Property Support

Whether you are acquiring, renovating, or refinancing, we provide capital that helps you execute your property strategy.

Bridge Financing Solutions

Close deals now and refinance later. Our bridge products help you move on opportunities without waiting for permanent financing.

All Real Estate Models Welcome

Fix and flip, buy and hold, property management, brokerage, development—we fund the full real estate spectrum.

Renovation and Rehab Capital

Fund renovations and improvements that increase property value. Capital for materials, contractors, and project costs.

Portfolio Growth Support

Scale your property portfolio without being limited by transaction timing. Our capital helps you grow strategically.

Funding Built for Real Estate Timelines

Whether you need to close on a property quickly, fund a renovation project, or bridge to permanent financing, we have solutions designed for real estate professionals.

Real estate moves at its own speed. Deals come together quickly and require fast capital. Renovations need funding before rental income starts. Transaction timing rarely aligns perfectly. We have spent years learning real estate economics so we can provide capital that matches the urgency of property opportunities.

Real Estate Business Funding Overview

We offer multiple products for different real estate needs. Some professionals need bridge financing for deals. Others need working capital for operations. Many use a combination as their portfolio grows.

Most real estate professionals qualify for multiple products. Your funding advisor will help structure the right approach for your property strategy.

Financing Options for Real Estate Professionals

Different property needs call for different solutions. Here are the products real estate professionals use most frequently.

How Credit Affects Real Estate Financing

Your personal credit score is one factor, but not everything. We evaluate the complete picture: property portfolio, deal history, equity position, and overall business performance.

Good News

Real estate professionals with credit scores in the 500s regularly qualify for funding when they demonstrate solid deal history and healthy equity positions. Your property portfolio tells the story.

Strong Credit Profile

Access to lowest rates, highest leverage, longest terms

Challenged Credit

Multiple options available based on deal quality

Real Estate Industry Funding Insights

2-3

average weeks to close traditional bank financing. Our speed lets you compete with cash buyers and move on opportunities quickly.

(Source: National Association of Realtors)

70%+

of real estate investors use leverage for property acquisitions. Strategic financing is standard practice in successful real estate investing.

(Source: Real Estate Investment Survey)

$50K+

typical renovation budget for fix and flip properties. Our funding helps you invest in improvements that drive returns.

(Source: Investor Industry Data)

Evaluating Real Estate Financing

Move quickly on property opportunities

Fund renovations to increase value

Bridge transaction timing gaps

Scale your portfolio strategically

Compete with cash buyers

Build credit history for better future terms

Financing costs reduce deal margin

Short-term products require refinancing

Personal guarantees typically required

Fast funding costs more than bank loans

Compare Real Estate Funding Options

| Loan Type | Max Amount | Rates | Speed |

|---|---|---|---|

| Bridge Financing | $50K to $1M | 1% to 3% monthly | 3 to 7 days |

| Fix and Flip Funding | $25K to $500K | 1% to 3% monthly | 24 to 48 hours |

| Business Line of Credit | $25K to $5M | 1% to 3% monthly | 1 to 3 days |

| Revenue-Based Financing | $25K to $500K | 1% to 5% monthly | 1 to 3 days |

| SBA Loan | $50K to $1M | Prime + 2.75% | 8 to 12 weeks |

Real Estate Business Qualification Requirements

$15K+

Monthly Revenue

550+

Credit Score

1+ year

Time in Business

Get Funding for Your Real Estate Business

Apply today and receive funding decisions quickly. Our team understands real estate financing and property investment timelines.

Start Your Application

Complete a short application about your real estate focus, current portfolio, and funding needs.

Upload recent bank statements and basic business information. Deal-specific documentation may be requested for larger amounts.

Review your offers, choose the best fit, and receive funds. Most real estate professionals get funded within 24 to 48 hours.

Real Estate Funding Products

Explore specific financing options available for your property business.

Related Industries We Fund

We also specialize in financing for these related industries.

Real Estate Financing Questions

We fund fix and flip investors, buy and hold investors, property management companies, real estate brokerages, and property developers.

No, these are business loans for real estate professionals. They are faster and more flexible than traditional mortgages but have different structures.

Yes, working capital and lines of credit can be used for down payments, earnest money, and closing costs on investment properties.

We work with investors who have single properties or large portfolios. Established track records often qualify for higher amounts.

We generally require at least 12 months in business with some transaction history. Complete beginners may have limited options.

It matters, but deal quality and property equity often outweigh credit challenges. Strong portfolios and clear exit strategies help significantly.

Many real estate professionals receive funding within 24-48 hours. Larger amounts or complex deals may take slightly longer.

Basic requirements include bank statements, property details, and proof of business ownership. Deal-specific documentation for larger requests.

Ready to Close Your Next Deal?

Whether you need bridge financing, renovation capital, or portfolio growth funding, our team specializes in real estate business financing.

How much funding do you need?

Drag the slider or type an amount

Applying is free and won't impact your credit score