Capital That Helps Your Business Flourish

Landscaping businesses grow by expanding routes, adding crews, and investing in better equipment. We provide funding that aligns with seasonal revenue patterns and helps you capture more of the busy season.

What You Need to Qualify

$5,000+

Minimum Monthly Revenue

3+ months

Established Business History

How much funding do you need?

Drag the slider or type an amount

Applying is free and won't impact your credit score

From Application to Funding Before Peak Season

Share your service types, customer base, and what you need funding for. We understand lawn care, landscaping, and outdoor service operations.

We assess your business with knowledge of seasonal patterns, commercial contracts, and the economics of outdoor service businesses.

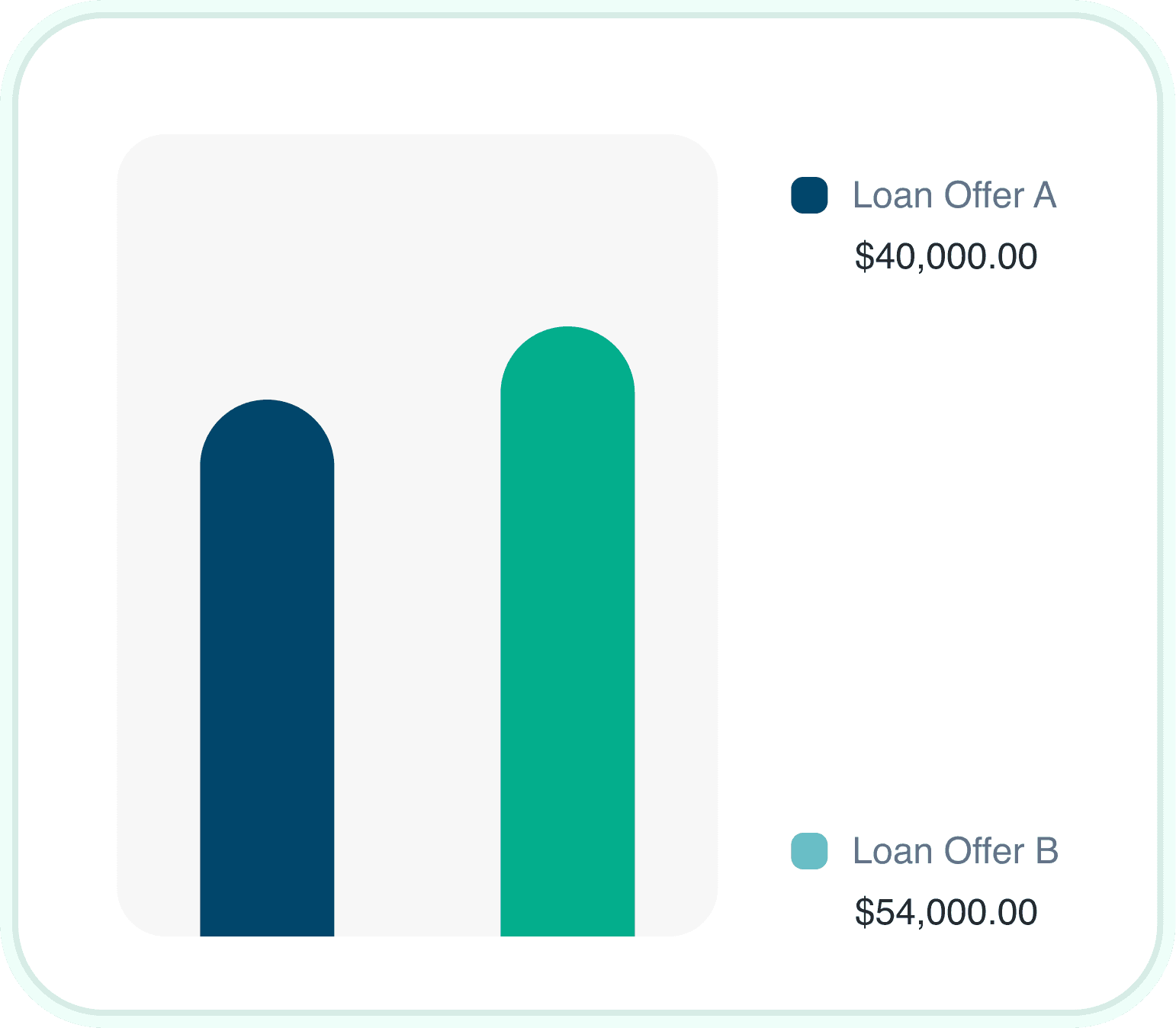

Review funding offers with payment structures that can account for seasonal revenue fluctuations. Pick what works for your business.

Funds arrive quickly—often within 24-48 hours. Buy mowers, add trucks, or hire crews before spring arrives.

Why Landscaping Business Owners Choose Us

We Understand Seasonal Revenue

Revenue peaks in spring and summer but costs continue year-round. We structure funding that accounts for slower winter months.

Equipment That Expands Capacity

Commercial mowers, trucks, trailers, and specialty equipment help you serve more customers. Our financing keeps your fleet competitive.

Crew Scaling Support

Adding crews to take on more work requires equipment and payroll before new revenue arrives. Our working capital bridges this gap.

All Outdoor Services Welcome

Lawn maintenance, landscape design, irrigation, hardscaping, tree services, snow removal—we fund the full spectrum of outdoor services.

Commercial Contract Growth

Landing property management and commercial accounts requires capacity. Our funding helps you scale to serve larger clients.

Fast Decisions for Seasonal Timing

Spring arrives fast and equipment deals do not wait. Our speed helps you prepare before your busy season.

Funding Built for Landscaping Business Realities

Whether you need to upgrade your mower fleet, add work trucks, or bridge cash flow during winter, we have funding solutions designed for outdoor service businesses.

Landscaping businesses face unique seasonal pressures. Revenue concentrates in warmer months. Equipment needs constant updating. Competition for commercial accounts requires professional capacity. We have spent years learning the landscaping industry so we can provide capital that works with nature's schedule, not against it.

Landscaping Business Funding Overview

We offer multiple products to address different landscaping needs. Some owners need equipment financing for fleet expansion. Others need working capital for crew payroll. Many use a combination as their route list grows.

Most landscaping businesses qualify for multiple products. Your funding advisor will help compare options and recommend the best approach.

Financing Options for Landscaping Businesses

Different business needs call for different solutions. Here are the products landscaping companies use most frequently.

How Credit Affects Landscaping Business Financing

Your personal credit score is one factor, but not everything. We evaluate the complete picture: service revenue, contract roster, equipment equity, and overall business performance.

Good News

Landscaping business owners with credit scores in the 500s regularly qualify for funding when they demonstrate solid seasonal revenue and healthy commercial accounts. Your business performance tells the story.

Strong Credit Profile

Access to lowest rates, longest terms, highest amounts

Challenged Credit

Multiple options available based on business performance

Landscaping Industry Funding Insights

$130B+

annual US landscaping services industry revenue. Growing demand for professional outdoor services creates opportunities for well-equipped businesses.

(Source: IBIS World)

60-70%

of annual landscaping revenue occurs in spring and summer. Strategic capital helps smooth operations through slower winter months.

(Source: National Association of Landscape Professionals)

$15K-$50K

typical annual equipment investment for growing landscaping companies. Our financing helps spread these costs over time.

(Source: Landscape Industry Survey)

Evaluating Landscaping Business Financing

Upgrade mowers and equipment for more capacity

Add trucks and trailers to expand routes

Bridge cash flow through winter months

Scale crew for commercial contracts

Purchase equipment before busy season

Build credit history for better future terms

Financing costs reduce overall margin

Some products require frequent payments

Personal guarantees may be required

Fast funding options typically cost more

Compare Landscaping Funding Options

| Loan Type | Max Amount | Rates | Speed |

|---|---|---|---|

| Equipment Financing | $10K to $300K | 6% to 18% APR | 3 to 7 days |

| Working Capital Loan | $10K to $250K | 1% to 3% monthly | 24 to 48 hours |

| Invoice Factoring | $10K to $200K | 1% to 4% per invoice | 24 to 48 hours |

| Business Line of Credit | $10K to $150K | 1% to 3% monthly | 1 to 3 days |

| Revenue-Based Financing | $10K to $5M | 1% to 5% monthly | 1 to 3 days |

Landscaping Business Qualification Requirements

$10K+

Monthly Revenue

500+

Credit Score

6+ months

Time in Business

Get Funding for Your Landscaping Business

Apply today and receive funding decisions quickly. Our team understands landscaping financing and seasonal outdoor service needs.

Start Your Application

Complete a short application about your business, including your services, route size, and funding needs.

Upload recent bank statements and basic business information. We review them with an understanding of seasonal revenue patterns.

Review your offers, choose the best fit, and receive funds. Many landscaping owners get funded the same day.

Landscaping Business Funding Products

Explore specific financing options available for your landscaping company.

Related Industries We Fund

We also specialize in financing for these related industries.

Landscaping Business Financing Questions

We fund lawn maintenance, landscape design and installation, irrigation, hardscaping, tree services, commercial grounds maintenance, and snow removal operations.

Yes, we understand seasonal patterns and can structure payments that account for revenue fluctuations throughout the year.

We work with residential and commercial landscaping companies. Commercial contract holders often qualify for higher amounts due to predictable revenue.

Yes, we finance both new and used landscaping equipment. Used mowers and equipment are common and acceptable.

Many landscaping owners receive funding the same day, letting you purchase equipment immediately before busy season.

It matters, but business performance often outweighs credit challenges. Strong seasonal revenue and commercial contracts matter significantly.

Yes, we fund year-round landscaping businesses including those that offer snow removal services in winter months.

Basic requirements include 3-6 months of bank statements, a valid ID, and proof of business ownership.

Ready to Grow Your Landscaping Business?

Whether you need equipment, fleet expansion, or seasonal capital, our team specializes in landscaping business financing and understands outdoor service needs.

How much funding do you need?

Drag the slider or type an amount

Applying is free and won't impact your credit score