Capital That Keeps Your Fleet on the Road

Trucking and transportation businesses need capital that moves as fast as freight. We provide funding designed for the unique cash flow challenges of the industry—from fleet expansion to fuel costs to bridging payment delays.

What You Need to Qualify

$5,000+

Minimum Monthly Revenue

3+ months

Established Business History

How much funding do you need?

Drag the slider or type an amount

Applying is free and won't impact your credit score

From Application to Funding at Freight Speed

Share your fleet size, monthly revenue, and what you need funding for. We understand owner-operators, small fleets, and large carriers alike.

We assess your business with knowledge of freight payment cycles, lane economics, and the capital requirements of transportation.

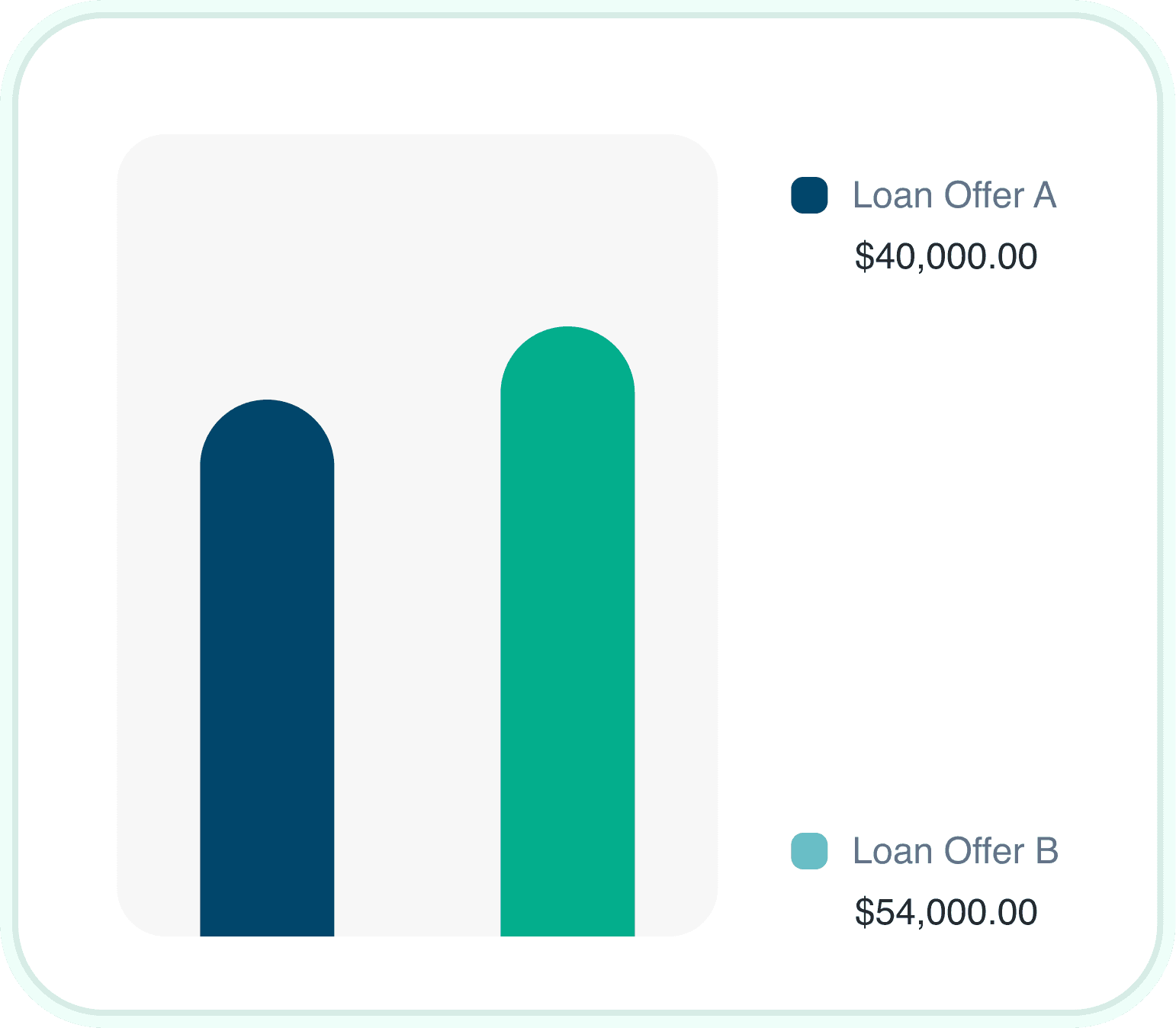

Review multiple funding offers with different structures. Pick what works for your cash flow and growth plans.

Funds arrive quickly—often within 24-48 hours. Fill fuel tanks, make repairs, expand your fleet, or cover payroll.

Why Trucking Companies Choose Us for Funding

We Understand Freight Payment Cycles

Brokers and shippers often pay 30-90 days after delivery. We structure funding that bridges these gaps so you can keep trucks rolling.

Fleet Expansion Support

Growing your fleet requires major capital. Our equipment financing helps you add trucks and trailers with manageable payments.

Fuel and Operating Capital

Diesel prices fluctuate, but fuel costs never stop. Our working capital solutions cover fuel, maintenance, and driver pay.

All Carrier Types Welcome

Owner-operators, small fleets, large carriers, local delivery, long-haul—we fund the full spectrum of transportation businesses.

Freight Factoring Alternative

Our working capital solutions can complement or replace traditional freight factoring, often with better terms for strong carriers.

Fast Decisions for Fast Industry

Trucks sitting idle lose money. Equipment breakdowns cannot wait. Our speed matches the urgency of transportation.

Funding Built for the Realities of Trucking

Whether you need to expand your fleet, cover fuel costs, or bridge payment delays from shippers, we have funding solutions designed for transportation businesses.

Transportation businesses face unique financial pressures. You deliver loads today but get paid in 30-90 days. Fuel costs are constant. Equipment failures stop revenue immediately. We have spent years learning the freight industry so we can provide capital that keeps your operation moving profitably.

Transportation Business Funding Overview

We offer multiple products to address different trucking needs. Some carriers need fleet financing for expansion. Others need working capital to bridge payment gaps. Many use a combination as their operation grows.

Most trucking companies qualify for multiple products. Your funding advisor will help compare options and recommend the best approach.

Financing Options for Trucking Businesses

Different operations call for different solutions. Here are the products trucking companies use most frequently.

How Credit Affects Trucking Business Financing

Your personal credit score is one factor, but not everything. We evaluate the complete picture: fleet size, freight contracts, revenue history, and accounts receivable quality.

Good News

Trucking company owners with credit scores in the 500s regularly qualify for funding when they demonstrate solid freight revenue and reliable contracts. Your operational performance tells the story.

Strong Credit Profile

Access to lowest rates, longest terms, highest amounts

Challenged Credit

Multiple options available based on business performance

Trucking Industry Funding Insights

30-90

average days to receive payment from brokers and shippers. Our funding bridges this gap so you can fuel, maintain, and pay drivers today.

(Source: Freight Industry Data)

$180K+

average cost of a new Class 8 tractor. Our equipment financing helps you expand your fleet without depleting cash reserves.

(Source: American Trucking Associations)

70%

of trucking companies use some form of external financing. Capital is a normal, strategic part of transportation operations.

(Source: Owner-Operator Survey)

Evaluating Trucking Business Financing

Bridge payment gaps from brokers and shippers

Expand your fleet with manageable payments

Cover fuel and maintenance costs immediately

Take on larger contracts with capital backing

Handle equipment repairs without downtime

Build credit history for better future terms

Financing costs reduce overall margin

Some products require frequent payments

Personal guarantees may be required

Fast funding options typically cost more

Compare Trucking Funding Options

| Loan Type | Max Amount | Rates | Speed |

|---|---|---|---|

| Freight Factoring | $25K to $500K | 1% to 4% per invoice | 24 to 48 hours |

| Equipment Financing | $50K to $1M | 6% to 18% APR | 3 to 7 days |

| Working Capital Loan | $25K to $500K | 1% to 3% monthly | 24 to 48 hours |

| Business Line of Credit | $25K to $5M | 1% to 3% monthly | 1 to 3 days |

| Revenue-Based Financing | $25K to $500K | 1% to 5% monthly | 1 to 3 days |

Trucking Business Qualification Requirements

$15K+

Monthly Revenue

500+

Credit Score

6+ months

Time in Business

Get Funding for Your Trucking Business

Apply today and receive funding decisions quickly. Our team understands trucking financing and the unique needs of freight carriers.

Start Your Application

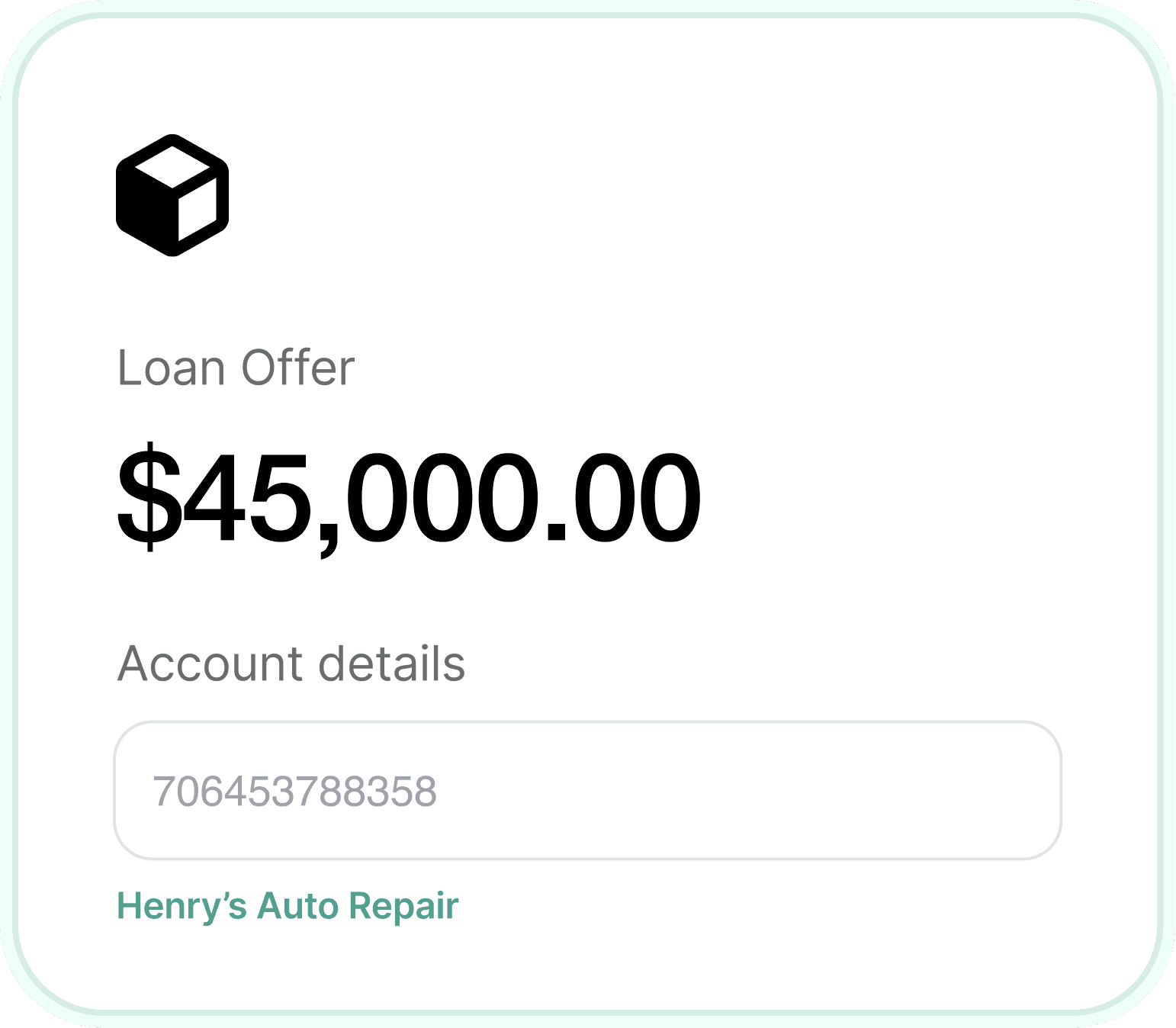

Complete a short application about your operation, including fleet size, monthly revenue, and funding needs.

Upload recent bank statements and basic business information. We review them with an understanding of freight industry patterns.

Review your offers, choose the best fit, and receive funds. Most trucking companies get funded within 24 to 48 hours.

Trucking Business Funding Products

Explore specific financing options available for your transportation business.

Related Industries We Fund

We also specialize in financing for these related industries.

Trucking Business Financing Questions

Yes, we work with owner-operators, small fleets, and large transportation companies alike. Fleet size does not disqualify you from funding.

Fleet expansion, fuel costs, maintenance and repairs, insurance, permits, driver payroll, and any legitimate business purpose.

We offer working capital solutions that can complement or replace traditional freight factoring, often with more flexibility and potentially better terms for strong carriers.

Yes, we finance both new and used semi trucks, trailers, and commercial vehicles. Used equipment financing is common in transportation.

We evaluate each situation individually. Being current on compliance matters, but past issues do not automatically disqualify you.

It matters, but your trucking operation's performance often outweighs credit challenges. Strong freight revenue and contracts matter significantly.

Many carriers receive decisions within 24 hours and funding within 24-48 hours. Equipment financing takes slightly longer, typically 3-7 days.

Basic requirements include 3-6 months of bank statements, MC authority documentation, and proof of business ownership. Larger amounts require additional documentation.

Ready to Keep Your Fleet Moving?

Whether you need fleet financing, working capital, or fuel funding, our team specializes in trucking business financing and understands your unique challenges.

How much funding do you need?

Drag the slider or type an amount

Applying is free and won't impact your credit score