Funding Built for Restaurant Success

The food service industry moves fast. Equipment breaks, opportunities appear, seasons change. We provide capital that matches your pace with same-day decisions and flexible terms designed specifically for restaurants.

What You Need to Qualify

$5,000+

Minimum Monthly Revenue

3+ months

Established Business History

How much funding do you need?

Drag the slider or type an amount

Applying is free and won't impact your credit score

From Kitchen to Capital in 4 Steps

Share your restaurant type, monthly sales, and funding needs. We understand food service, so the questions make sense.

Our team evaluates your restaurant quickly. We know how to read food service financials and value your business fairly.

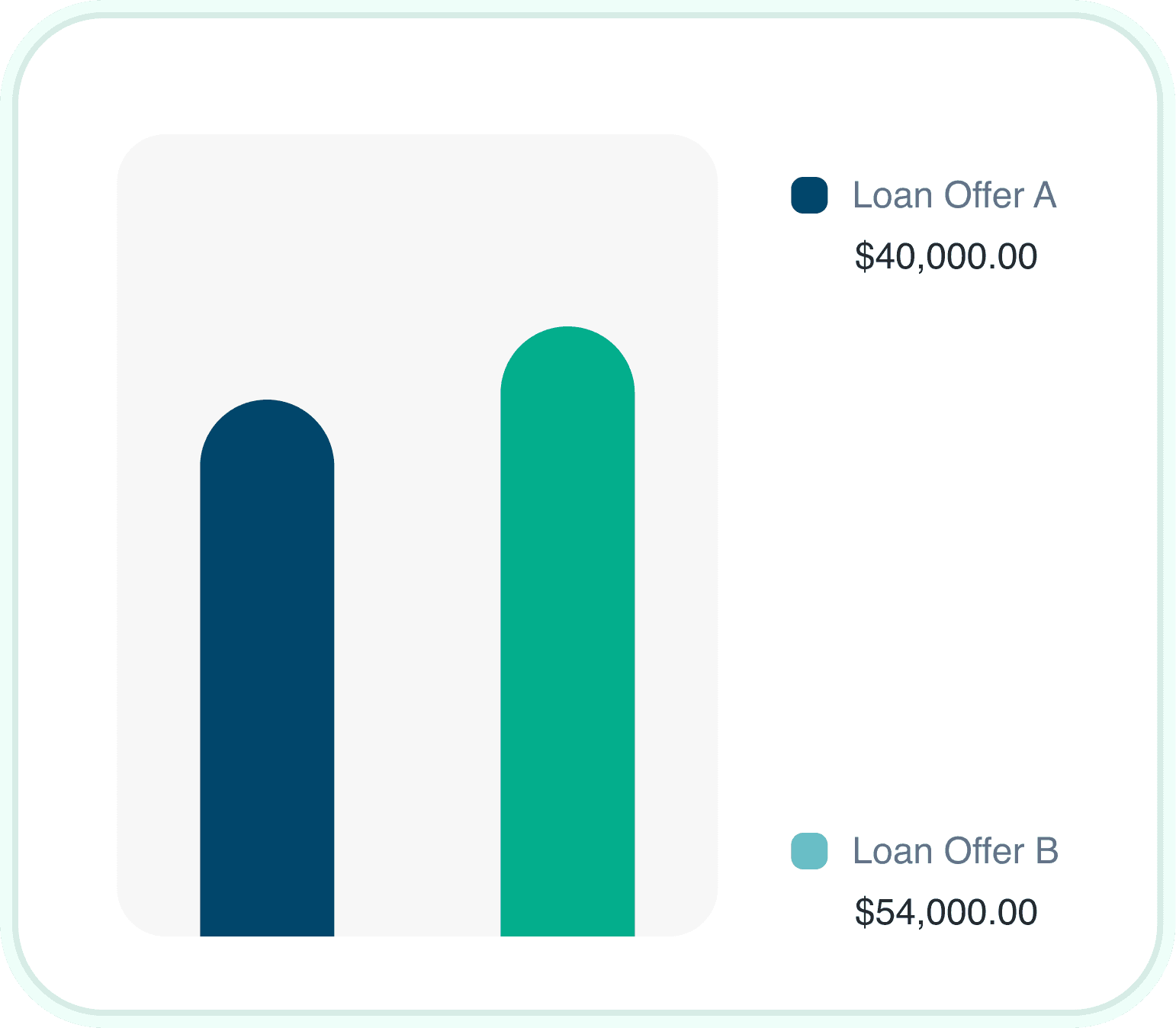

Receive multiple funding offers with different structures. Pick what works for your cash flow and growth plans.

Capital arrives in your account, often within 24 hours. Put it to work immediately on whatever your restaurant needs.

Why Restaurant Owners Choose Us

We Understand Food Service

Our team knows restaurant economics. We evaluate your business the way it should be evaluated, not like a generic retail shop.

Fast Decisions, Fast Funding

When your walk-in cooler fails at 2pm, you cannot wait 6 weeks for bank approval. We move at restaurant speed.

Flexible Payment Structures

Choose daily, weekly, or monthly payments. Some options even adjust based on your actual sales volume.

All Restaurant Types Welcome

Fine dining, fast casual, food trucks, catering, bars, cafes, bakeries. We fund every corner of the industry.

Seasonal Awareness

We understand that December looks different than February. Our terms account for the natural rhythms of food service.

No Menu of Hidden Fees

Every cost disclosed upfront. We believe in transparency, just like your ingredient sourcing.

Capital Solutions for Every Restaurant Need

Whether you are opening a second location, upgrading your kitchen, or just need to cover payroll during a slow month, we have funding options designed for your situation.

Restaurant owners face unique challenges that generic lenders do not understand. Seasonal revenue swings, thin margins, equipment dependencies, and inventory needs require specialized financing. We have spent years learning the food service industry so we can provide capital that actually works for your business model.

Restaurant Funding at a Glance

We offer multiple funding products to match different restaurant needs. Some owners need equipment financing with long terms. Others need quick working capital with flexible repayment. Many use a combination over time.

Most restaurant owners qualify for multiple products. Your funding advisor will help you compare options and choose the best fit.

Funding Products for Restaurants

Different needs call for different solutions. Here are the products restaurant owners use most frequently.

How Credit Affects Restaurant Financing

Your personal credit score matters, but it is not everything. We evaluate the whole picture: your restaurant's revenue, time in business, industry experience, and cash flow patterns.

Good News

Restaurant owners with credit scores in the 500s regularly qualify for funding when they show strong, consistent sales. Your credit card processing statements often tell the real story.

Strong Credit Profile

Access to lowest rates, longest terms, highest amounts

Challenged Credit

Multiple options available based on restaurant performance

Restaurant Industry Funding Data

$1M+

average revenue for independent full-service restaurants. We fund restaurants of all sizes, from food trucks to multi-location groups.

(Source: National Restaurant Association)

3-5%

typical profit margin in full-service restaurants. We understand thin margins and structure funding accordingly.

(Source: Industry Benchmarks)

60%

of restaurants use some form of external financing. Capital is a normal part of restaurant operations and growth.

(Source: Restaurant Finance Survey)

Weighing Restaurant Financing Options

Access capital for equipment, expansion, or operations

Fund seasonal inventory ahead of busy periods

Bridge cash flow gaps during slow months

Take advantage of growth opportunities quickly

Multiple product options to fit different needs

Build credit history for better future terms

Financing has costs that reduce overall margin

Some products require frequent payments

Personal guarantees may be required

Fast funding typically costs more than bank loans

Compare Restaurant Funding Options

| Loan Type | Max Amount | Rates | Speed |

|---|---|---|---|

| Merchant Cash Advance | $10K to $5M | Factor 1.1 to 1.5 | 24 to 48 hours |

| Equipment Financing | $10K to $5M | 6% to 20% APR | 3 to 7 days |

| Working Capital Loan | $25K to $5M | 1% to 4% monthly | 24 to 48 hours |

| Business Line of Credit | $10K to $250K | 1% to 3% monthly | 1 to 3 days |

| Revenue Based Financing | $10K to $5M | 1% to 6% monthly | 1 to 2 days |

| SBA Loan | $50K to $5M | Prime + 2.75% | 8 to 12 weeks |

Restaurant Qualification Requirements

$10K+

Monthly Revenue

475+

Credit Score

6+ months

Time in Business

Get Funding for Your Restaurant

Apply today and receive funding decisions fast. Our team specializes in restaurant financing and understands your business.

Start Your Application

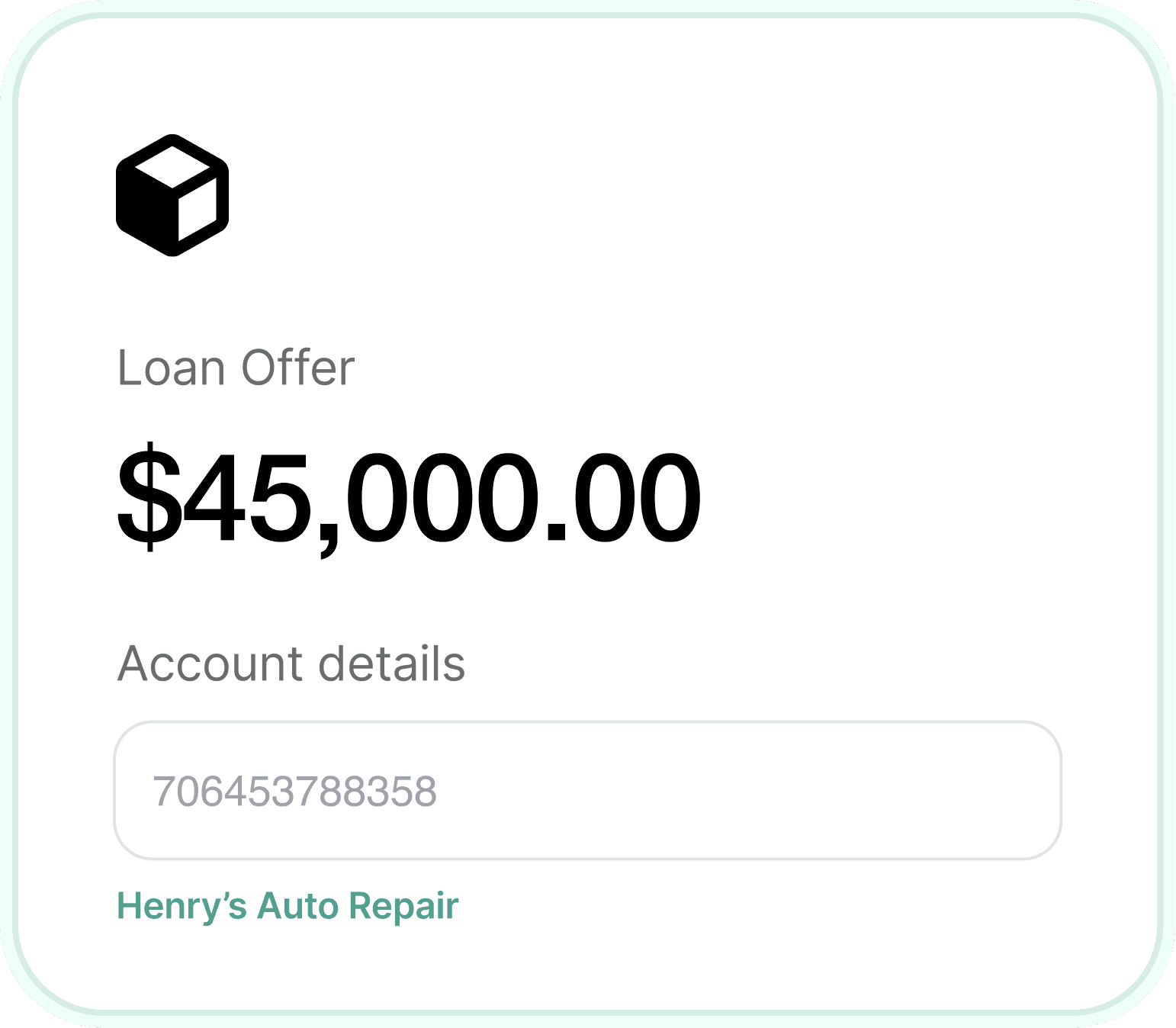

Complete a short application about your restaurant, including type, location, monthly revenue, and funding needs.

Upload recent bank statements and processing statements. We review them with an understanding of restaurant cash flow patterns.

Review your offers, choose the best fit, and receive funds. Most restaurant owners get funded within 24 to 48 hours.

Restaurant Funding Products

Explore specific financing options available for your restaurant.

Related Industries We Fund

We also specialize in financing for these related industries.

Restaurant Financing Questions

We fund all types: full-service restaurants, fast casual, quick service, cafes, coffee shops, bars, breweries, food trucks, catering companies, bakeries, pizzerias, and more. If you serve food or beverages, we likely have a solution for you.

Yes, though requirements vary. Newer restaurants typically need at least 6 months of operation and consistent revenue. Experienced owners opening new concepts may have additional options based on their track record.

Virtually any business purpose: kitchen equipment, POS systems, furniture, renovations, inventory, payroll, marketing, delivery vehicles, franchise fees, new location build-out, or general working capital.

We understand seasonality. Some of our products have payments that adjust with revenue. We can also structure terms to align payments with your busy season when possible.

It factors into your options, but strong restaurant performance often outweighs credit challenges. We have funded many restaurant owners with credit scores below 600 who demonstrate solid sales.

Many restaurant owners receive decisions within hours and funding within 24 to 48 hours. Equipment financing and SBA loans take longer due to additional requirements.

It depends on the product. Merchant cash advances and revenue-based financing typically require no collateral. Equipment financing uses the equipment itself. Lines of credit and term loans may require a UCC filing.

Basic requirements include 3 to 6 months of bank statements, credit card processing statements (if applicable), a valid ID, and proof of business ownership. Larger amounts or SBA loans require additional documentation.

In many cases, yes. We evaluate your total debt obligations and ability to service new funding. Many restaurant owners have multiple funding sources at different stages of growth.

We specialize in food service. Our team understands restaurant economics, seasonal patterns, and industry challenges. We evaluate your business the right way and structure funding that makes sense for restaurants.

Ready to Grow Your Restaurant?

Whether you need equipment, working capital, or expansion funding, our team is ready to help. We specialize in restaurant financing.

How much funding do you need?

Drag the slider or type an amount

Applying is free and won't impact your credit score