Capital That Keeps Your Placements Paid

Staffing agencies pay workers weekly while clients pay monthly. We provide funding designed to bridge this gap—so you can meet payroll, grow your placements, and never turn down a good opportunity because of cash flow.

What You Need to Qualify

$5,000+

Minimum Monthly Revenue

3+ months

Established Business History

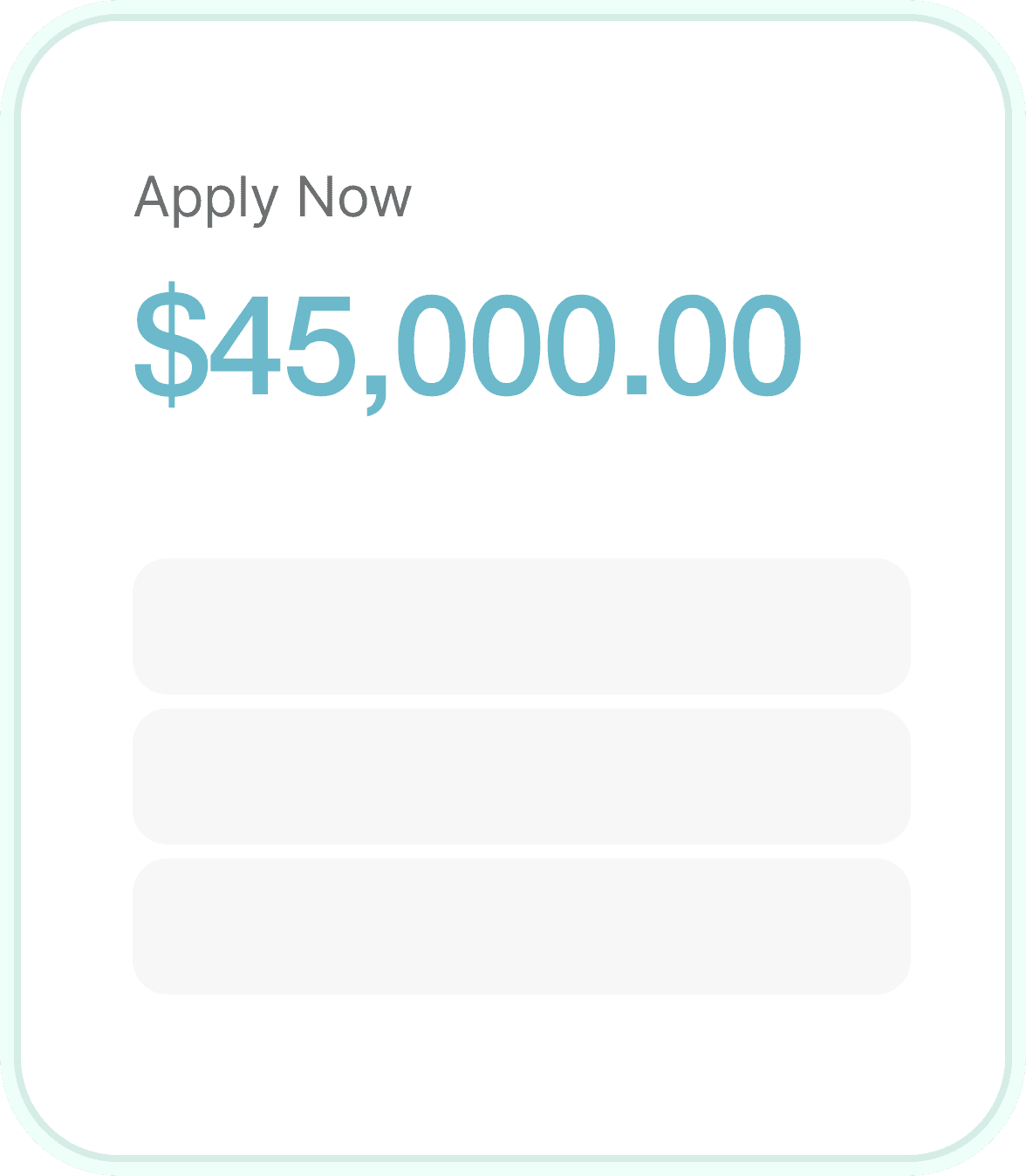

How much funding do you need?

Drag the slider or type an amount

Applying is free and won't impact your credit score

From Application to Payroll Coverage Fast

Share your staffing specialty, client base, and what you need funding for. We understand temp, permanent, and contract placement models.

We assess your business with knowledge of placement economics, client payment cycles, and the unique cash flow challenges of staffing.

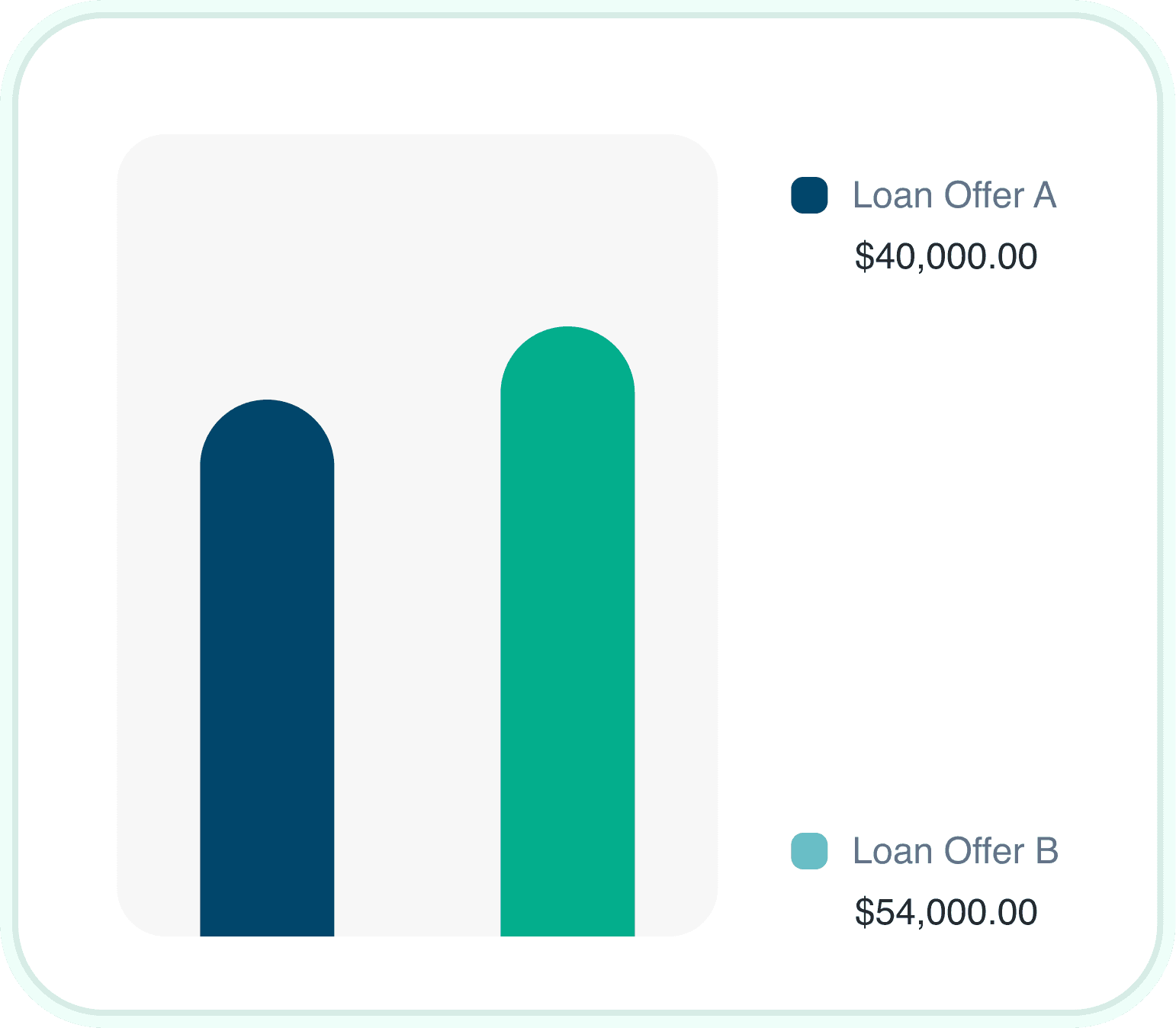

Review funding offers designed for staffing. Choose structures that align with your payroll schedule and client payment timing.

Funds arrive quickly—often same day. Meet this week's payroll, take on that new client, or expand your placement team.

Why Staffing Agency Owners Choose Us

We Solve the Payroll Gap

You pay workers Friday, but clients pay net-30 to net-60. Our funding bridges this fundamental cash flow challenge of staffing.

Grow Without Limitations

Never turn down a good placement because you cannot make payroll. Our funding grows with your placements and client roster.

Invoice Factoring Expertise

We specialize in converting your staffing invoices into immediate cash. Get paid when placements work, not when clients finally pay.

All Staffing Specialties Welcome

Healthcare staffing, IT placement, light industrial, administrative, executive search—we fund every staffing vertical.

Scale During Busy Seasons

Holiday rushes, seasonal spikes, and sudden client needs require capital flexibility. Our solutions scale with demand.

Same-Day Funding Available

Payroll deadlines do not wait. When you need to meet Friday payroll, we deliver capital on staffing industry timelines.

Funding Built for Staffing Agency Realities

Whether you need to cover weekly payroll, fund a major client expansion, or simply bridge the gap until invoices pay, we have solutions designed specifically for staffing.

Staffing agencies have the most challenging cash flow in business. You must pay workers weekly while clients pay monthly—or slower. Every new placement increases the gap. We have spent years specializing in staffing finance because we understand that your biggest opportunities create your biggest cash flow challenges.

Staffing Agency Funding Overview

We offer products specifically designed for staffing economics. Invoice factoring converts billings to cash. Payroll funding covers workers. Working capital supports growth. Most agencies use a combination.

Most staffing agencies qualify for multiple products. Your funding advisor will help structure the right combination for your agency's needs.

Financing Options for Staffing Agencies

Different staffing needs call for different solutions. Here are the products staffing agencies use most frequently.

How Credit Affects Staffing Agency Financing

Your personal credit score is one factor, but not everything. We evaluate the complete picture: placement volume, client quality, invoice portfolio, and overall agency performance.

Good News

Staffing agency owners with credit scores in the 500s regularly qualify for funding when they demonstrate solid placement volume and quality clients. Your client quality often matters more than your personal credit.

Strong Credit Profile

Access to lowest rates, highest advance percentages

Challenged Credit

Multiple options available based on client quality

Staffing Industry Funding Insights

30-60

average days for staffing clients to pay invoices. Meanwhile, you must pay workers weekly. Our funding bridges this unavoidable gap.

(Source: American Staffing Association)

$215B+

annual US staffing industry revenue. Growing demand for flexible workforce solutions creates opportunities for well-funded agencies.

(Source: Staffing Industry Analysts)

90%+

of staffing agencies use factoring or payroll funding. External financing is standard practice in the staffing industry.

(Source: Industry Survey)

Evaluating Staffing Agency Financing

Never miss payroll regardless of client payment timing

Grow placements without cash flow constraints

Take on larger clients and bigger orders

Scale during seasonal demand spikes

Expand to new markets and specialties

Build credit history for better future terms

Factoring fees reduce overall margin

Some programs have minimum volumes

Personal guarantees typically required

Client creditworthiness affects terms

Compare Staffing Funding Options

| Loan Type | Max Amount | Rates | Speed |

|---|---|---|---|

| Invoice Factoring | $25K to $5M | 1% to 4% per invoice | Same day |

| Payroll Funding | $25K to $500K | 1% to 3% monthly | 24 to 48 hours |

| Business Line of Credit | $25K to $5M | 1% to 3% monthly | 1 to 3 days |

| Revenue-Based Financing | $25K to $500K | 1% to 5% monthly | 1 to 3 days |

| SBA Loan | $50K to $1M | Prime + 2.75% | 8 to 12 weeks |

Staffing Agency Qualification Requirements

$25K+

Monthly Billings

500+

Credit Score

6+ months

Time in Business

Get Funding for Your Staffing Agency

Apply today and receive funding decisions quickly. Our team specializes in staffing agency financing and understands your payroll challenges.

Start Your Application

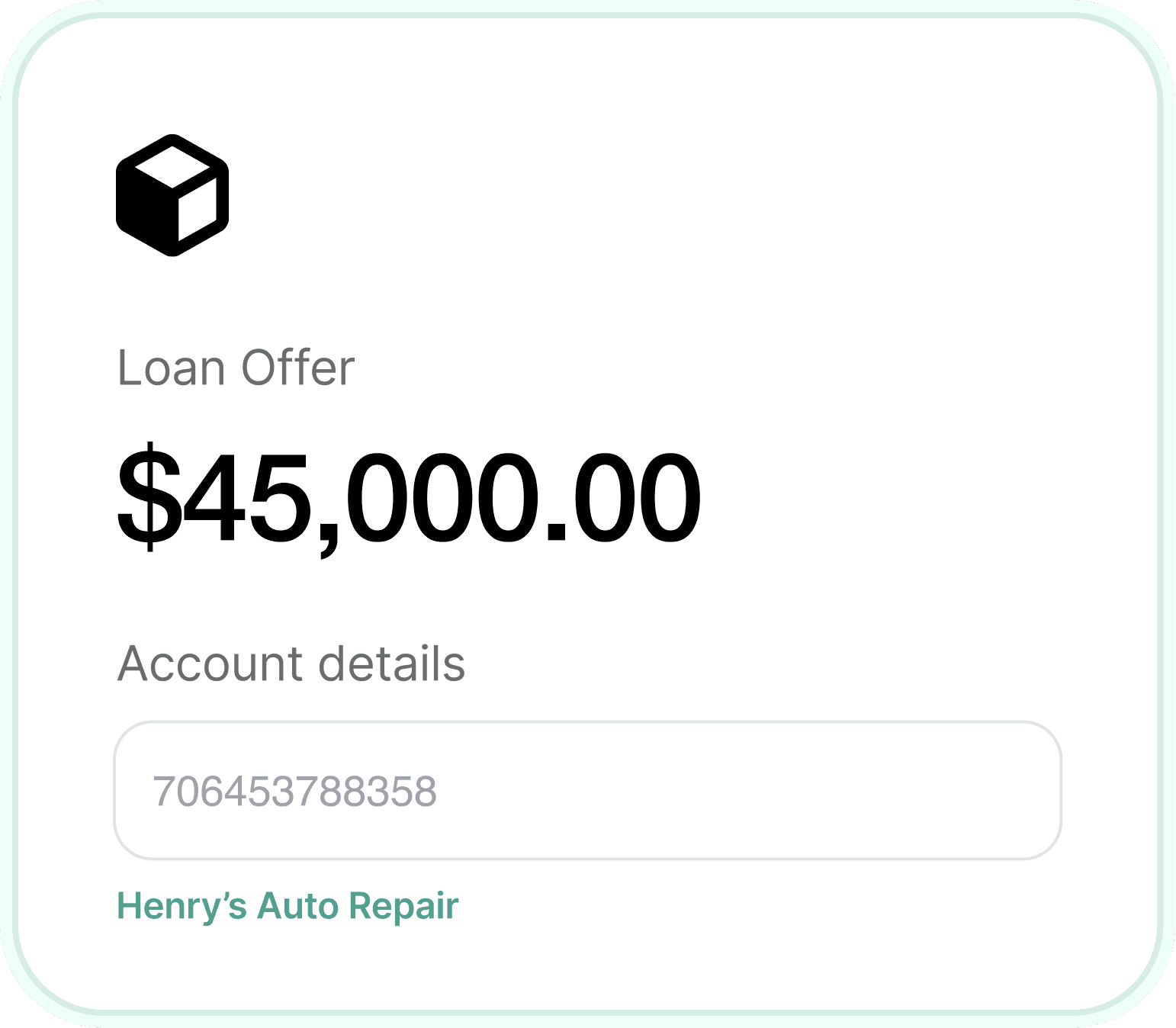

Complete a short application about your agency, including your specialty, monthly billings, and funding needs.

Upload recent bank statements, an aging report, and client information. We review with understanding of staffing economics.

Review your offers, choose the best fit, and receive funds. Many staffing agencies get funded the same day.

Staffing Agency Funding Products

Explore specific financing options available for your staffing agency.

Related Industries We Fund

We also specialize in financing for these related industries.

Staffing Agency Financing Questions

We fund healthcare staffing, IT placement, light industrial, administrative, clerical, executive search, and all staffing specialties.

You submit invoices to us after placements work. We advance you 80-95% immediately, then collect from your clients and remit the balance minus fees.

Programs vary. Some require factoring all invoices from participating clients, while others offer spot factoring for specific invoices.

Yes, in most staffing factoring arrangements, clients are notified to pay the factoring company directly. This is standard in the staffing industry.

Most staffing factoring is recourse, meaning you guarantee the invoice. However, we evaluate client credit and help you avoid problem accounts.

Many agencies receive same-day funding for approved invoices, ensuring you can meet payroll on time every week.

For factoring, your clients' creditworthiness matters most. For other products, your credit matters but is balanced against agency performance.

Basic requirements include bank statements, an accounts receivable aging, and client information. More established agencies qualify for better terms.

Ready to Grow Your Agency?

Whether you need payroll funding, invoice factoring, or growth capital, our team specializes in staffing agency financing and understands your unique cash flow needs.

How much funding do you need?

Drag the slider or type an amount

Applying is free and won't impact your credit score