Meet Payroll on Time, Every Single Time

Your employees count on you. Late payroll destroys morale, triggers turnover, and can even land you in legal trouble. Payroll funding gives you the capital to pay your team on schedule, no matter what your cash flow looks like this week.

What You Need to Qualify

$5,000+

Minimum Monthly Revenue

3+ months

Established Business History

How much funding do you need?

Drag the slider or type an amount

Applying is free and won't impact your credit score

Get Payroll Covered in 3 Simple Steps

Share your payroll amount, pay schedule, and how quickly you need funding. The application takes about 5 minutes.

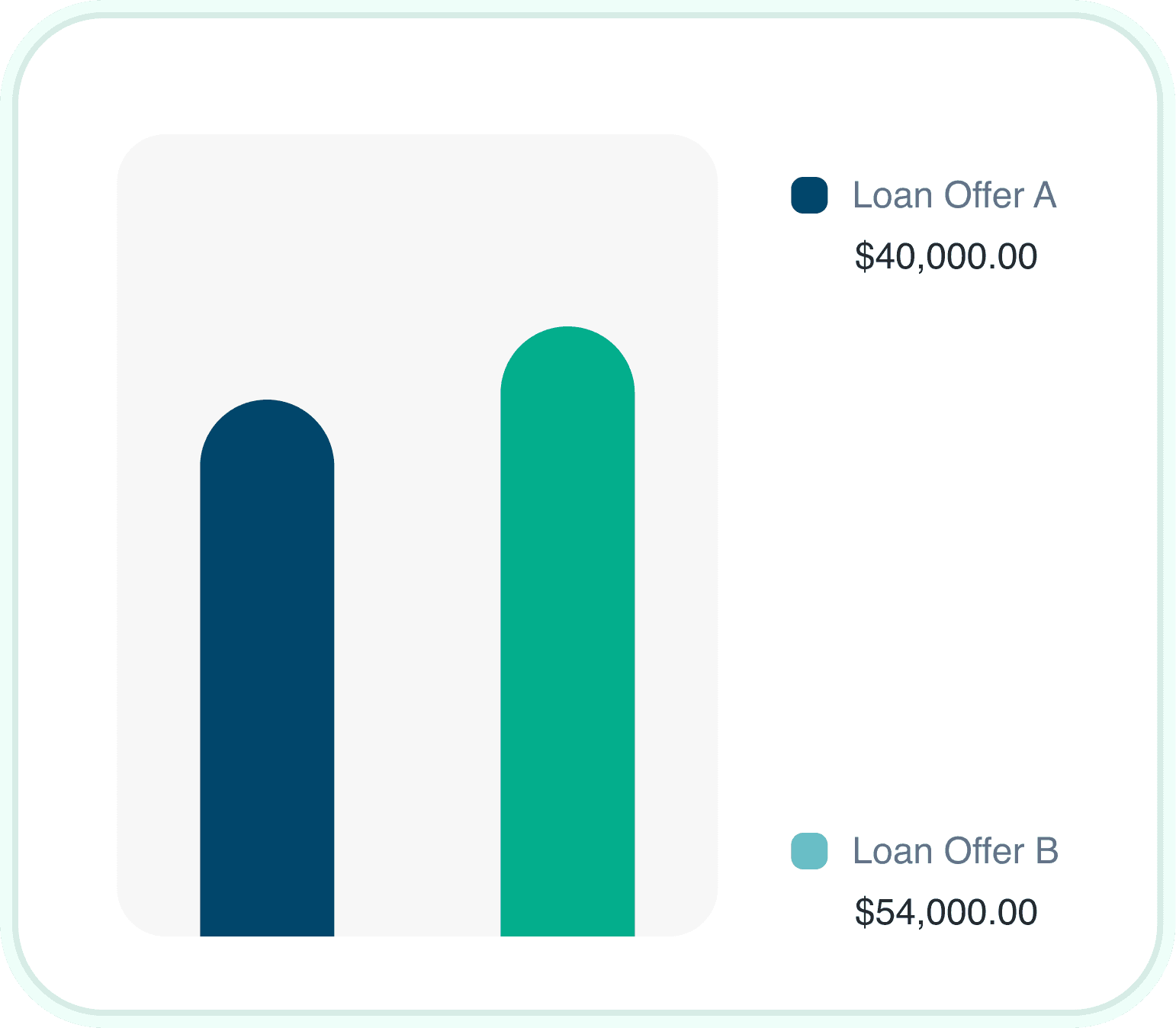

Receive multiple funding offers with terms that align to your pay cycles. See the total cost upfront before you commit.

Choose the option that fits your cash flow. We handle the paperwork so you can focus on your team.

Funds hit your account fast, typically within 24 hours. Run payroll with confidence and keep operations moving.

Why Business Owners Choose Payroll Funding

Never Miss a Pay Cycle

Whether revenue is delayed, a client pays late, or you hit a seasonal dip, payroll funding ensures your team gets paid on time, every time.

Retain Your Best Employees

Nothing drives top talent away faster than a missed or late paycheck. Payroll funding protects the workforce you have worked hard to build.

Avoid Legal and Tax Penalties

Late payroll can trigger state penalties, IRS issues, and even lawsuits. Payroll funding keeps you compliant and out of trouble.

Funding Aligned to Pay Schedules

Repayment terms are structured around your revenue cycles, not arbitrary bank timelines. Weekly, biweekly, or monthly options available.

Fast, Minimal Documentation

Three months of bank statements and basic business info. No lengthy underwriting, no weeks of waiting. Get approved the same day.

Scale Up as You Grow

Hiring more staff? Expanding to a new location? Payroll funding grows with your business so you can onboard with confidence.

Understanding Payroll Funding

Payroll funding is short-term capital designed specifically to help businesses cover employee wages when cash flow falls short. It bridges the gap between when revenue arrives and when your team needs to be paid.

For most businesses, payroll is the single largest recurring expense. When a big client pays late, a seasonal slowdown hits, or rapid growth outpaces revenue, the pressure to make payroll can be overwhelming. Payroll funding removes that pressure so you can focus on running your business instead of scrambling for cash every pay period.

Payroll Funding Details

Our payroll funding products are built for speed and reliability. Business owners use these funds to cover wages, payroll taxes, benefits, and contractor payments when cash flow timing does not align with pay schedules.

Funds can be used for any payroll-related expense including wages, payroll taxes, benefits contributions, and contractor payments.

Common Payroll Funding Scenarios

Business owners turn to payroll funding to navigate a wide range of cash flow challenges. Here are the situations we see most often.

Seasonal Revenue Dips

Your staff still needs to be paid during slow months. Payroll funding bridges the gap until revenue picks back up.

Late-Paying Clients

When customers pay net 30, 60, or 90, your payroll obligations do not wait. Funding covers the gap between invoicing and collection.

Rapid Hiring and Growth

Landed a big contract? Need to staff up fast? Payroll funding lets you hire now and pay your new team while revenue ramps up.

Tax Season and Benefits

Quarterly payroll taxes and annual benefits renewals can create cash crunches. Dedicated funding smooths out these spikes.

Project-Based Revenue Gaps

Construction, staffing, and service businesses often have gaps between project starts and milestone payments. Payroll funding fills the hole.

Emergency Situations

Equipment failure, natural disaster, or a lost account. When revenue drops unexpectedly, your team still deserves to be paid.

Credit Requirements for Payroll Funding

Payroll funding is available across a range of credit profiles. Lenders focus heavily on your business revenue and payroll history, not just your personal credit score.

Good News

Business owners with credit scores from 500 to 800 qualify for payroll funding every day. Strong revenue and a solid payroll track record can offset credit challenges.

Excellent Credit (700+)

Lowest rates, highest amounts, and longest terms available

Fair Credit (500-699)

Competitive options based on revenue and payroll consistency

Payroll Funding Industry Insights

25%

of small businesses report payroll as their biggest cash flow challenge. Meeting payroll on time is critical to employee retention and business survival.

(Source: National Small Business Association Survey)

$150K

average payroll funding amount for small to mid-size businesses. Most use funds to cover 1 to 3 pay cycles during cash flow gaps.

(Source: Industry Analysis 2024)

60%

of employees say they would start looking for a new job after just one late paycheck. Reliable payroll is the foundation of employee retention.

(Source: APA Workforce Survey)

Evaluating Payroll Funding

Meet payroll on time, every time regardless of cash flow

Retain employees and avoid costly turnover

Stay compliant with wage and tax obligations

Repayment terms aligned with your revenue cycles

Fast approval with minimal documentation

Scale funding as your team grows

Higher cost than traditional bank lines of credit

Shorter repayment periods than long-term loans

Requires consistent business revenue to qualify

Personal guarantee may be required for larger amounts

Compare Payroll Funding to Other Products

| Loan Type | Max Amount | Rates | Speed |

|---|---|---|---|

| Payroll Funding | $10K to $5M | 1% to 4% monthly | 24 to 48 hours |

| Working Capital Loan | $25K to $5M | 1% to 4% monthly | 24 to 48 hours |

| Business Line of Credit | $25K to $5M | 1% to 3% monthly | 1 to 3 days |

| Merchant Cash Advance | $10K to $5M | Factor 1.1 to 1.5 | 1 to 2 days |

| Revenue Based Financing | $10K to $5M | 1% to 6% monthly | 1 to 2 days |

| Invoice Financing | Up to 90% | 1% to 3% monthly | 24 to 48 hours |

Payroll Funding Qualification Requirements

500+

Credit Score

$15K+

Monthly Revenue

6+ months

Time in Business

Apply for Payroll Funding Today

The application takes minutes. Most business owners receive a funding decision the same day so you can make your next payroll with confidence.

Get Payroll Funded Now

Provide basic information about your business, payroll size, pay schedule, and how much funding you need. Takes about 5 minutes.

Upload your last 3 months of business bank statements. Larger payroll funding requests may require additional documentation.

Review funding offers, compare terms and costs, and select the option that aligns with your pay schedule and cash flow.

Alternative Funding Options

Depending on your situation, these products might also help you meet payroll and manage cash flow.

Working Capital Loans

General-purpose capital for any business expense

Learn MoreBusiness Line of Credit

Draw funds as needed, pay interest only on usage

Learn MoreInvoice Financing

Turn unpaid invoices into immediate cash

Learn MoreRevenue Based Financing

Payments that flex with your monthly revenue

Learn MorePayroll Funding by Industry

Specialized payroll funding programs with terms tailored to specific industry pay cycles and staffing needs.

Restaurant Payroll Funding

Cover kitchen and front-of-house staff

View IndustryConstruction Payroll Funding

Pay crews between project milestones

View IndustryHealthcare Payroll Funding

Fund clinical and administrative staff

View IndustryStaffing Agency Payroll Funding

Pay placed employees before client invoices clear

View IndustryPayroll Funding Questions

Payroll funding is a specialized form of working capital designed specifically for wage obligations. The underwriting considers your payroll history and employee count, and repayment terms are structured around your pay cycles. Working capital loans are more general-purpose.

Most payroll funding applications are approved the same day, with funds deposited within 24 to 48 hours. If you apply before noon ET, same-day funding may be available for urgent payroll needs.

Yes. Payroll funding covers all payroll-related expenses including gross wages, employer payroll taxes (FICA, FUTA, SUTA), health insurance contributions, retirement plan matches, and contractor payments.

Missing payroll can trigger state labor law violations, IRS penalties for unpaid payroll taxes, employee lawsuits, loss of key staff, and serious damage to company morale. Payroll funding helps you avoid all of these consequences.

Most payroll funding is unsecured, meaning no collateral is required. For larger amounts, a UCC filing or personal guarantee may be requested, but physical assets are rarely needed.

Payroll funding is available for credit scores starting at 500. Strong business revenue and a consistent payroll history can offset lower credit scores.

Repayments are typically structured as fixed daily or weekly ACH debits from your business bank account. This creates predictable payments that align with your revenue flow.

Absolutely. We work with many seasonal businesses. Funding can be structured to align with your busy and slow seasons so payments are manageable year-round.

Payroll funding amounts range from $10,000 to $5,000,000 based on your monthly revenue, payroll size, and overall business health. Most businesses qualify for enough to cover 1 to 3 full pay cycles.

Some lenders report payment history to business credit bureaus. Consistent on-time payments can help build your business credit profile and improve terms on future funding.

Never Miss Payroll Again

Apply in minutes and get the funding you need to pay your team on time. Our advisors are ready to help you find the right payroll solution.

How much funding do you need?

Drag the slider or type an amount

Applying is free and won't impact your credit score